Relocating Or Exiting Your Business From Myanmar

Op/Ed by Chris Devonshire-Ellis

- Myanmar business border relocation options with Cambodia, Laos, Vietnam, Bangladesh, China and India

- Wage, trade and incentive comparisons

- Winding Up a Myanmar Foreign Invested Company

The military coup in Myanmar is being resisted by elements within the country and the threat of some violence occurring has increased. The United States has placed sanctions on some of the Military concerned, and their families and as some of these control specific supply chains such as FDA approvals, the foreign investment operational environment in Myanmar could deteriorate – and fast. Contingency plans therefore are required to work out what to do if an exit is advisable.

Exit Triggers

The first elements to ascertain are the triggers for an exit:

1) Local safety; and working conditions;

2) Impact of sanctions (this may only affect certain nationals such as US citizens);

3) Reliability and sustainability of supplies;

4) Increasing operational costs such as electricity, fuel, energy;

5) Financing (at present Forex can only be transmitted through the Ayeyarwady (AYA) Bank);

6) Ability to export

All of these may be compromised. As business owners on the ground, you will be best able to monitor the risks. Before exiting however, alternative manufacturing domiciles need to be considered.

Alternative ASEAN

Hosting a company in ASEAN is useful because of the free trade nature of the bloc, meaning sourcing can be conducted duty free throughout ASEAN and its other member states Brunei, Cambodia, Indonesia, Laos, Malaysia, Philippines, Singapore, Thailand and Vietnam. All have their specific pros and cons depending upon specific industry sectors, although the majority of smaller foreign investment in Myanmar are in garments, agriculture, real estate and light manufacturing. ASEAN also has free trade agreements with China, and India, with both of these having recently been amended to provide improved market access.

There is also the recent RCEP agreement which includes Australia, New Zealand, Japan and South Korea. Manufacturers from these countries are specifically looking at investment destinations in the lower cost base nations in ASEAN, with Cambodia, Laos and until two weeks ago, Myanmar. It probably makes sense to look at lower-cost base manufacturing destinations in ASEAN as it can be presumed that this factor has been a driver in establishing a business in Myanmar in the first place. The minimum wage in Myanmar is calculated at 600 kyat (US$0.42) or 4,800 kyat per day (eight working hours). In which case, three main ASEAN candidates as Myanmar alternatives stand out:

Cambodia

An ASEAN member with all the trade benefits this brings, with a main port at Sihanoukville, onto the Gulf of Thailand, access to the Indian Ocean and good road and rail connections to China.

In Cambodia, the minimum wage is mainly guaranteed for workers in the country’s textiles and footwear manufacturing industry. The monthly rate minimum wage is US$190. Cambodia has some competitive advantages within its garment manufacturing industries as the government continues to delay taxing profits in the sector and eliminates export management fees. The European Union (EU) has an ‘Everything but Arms’ (EBA) program with Cambodia. Under the EBA agreement, Cambodia can export most goods to the EU free of duties. Getting equipment from Myanmar to Cambodia requires haulage through Thailand. We covered the options concerning establishing a business in Cambodia in our complimentary download Doing Business In ASEAN 2021.

Laos

Another ASEAN member, Laos is shortly to become a regional investment hot spot as it’s long awaited national rail network starts to become operational this year. The initial route connects Vientiane with China, with other routes later connecting through to Vietnam and Thailand. It will ease the difficulties of Laos being a landlocked nation. Exports are typically routed overland to other ASEAN nations or for shipping, through Vung An on the Vietnamese east coast. The minimum wage is US$124 per month. There is a border crossing from Myanmar to Laos over the Mekong River Friendship Bridge at Wan Pong-Kyainglap, linking Xieng Kok in Laos with Kyainglap in Myanmar. We covered the options concerning establishing a business in Laos in our complimentary download Doing Business In ASEAN 2021.

Vietnam

One of ASEAN’s most dynamic members, Vietnam has picked up a significant amount of manufacturing investment from companies exiting China and has proven itself as a major alternative player. Quite apart from its ASEAN trade benefits, the country also has trade agreements with the EU, UK and Russia. Generally excellent manufacturing and logistics facilities have seen the country develop significantly over the past decade. Following the country’s rapid economic growth, in the past few years, the Vietnamese government has increased minimum wages to combat inflation.

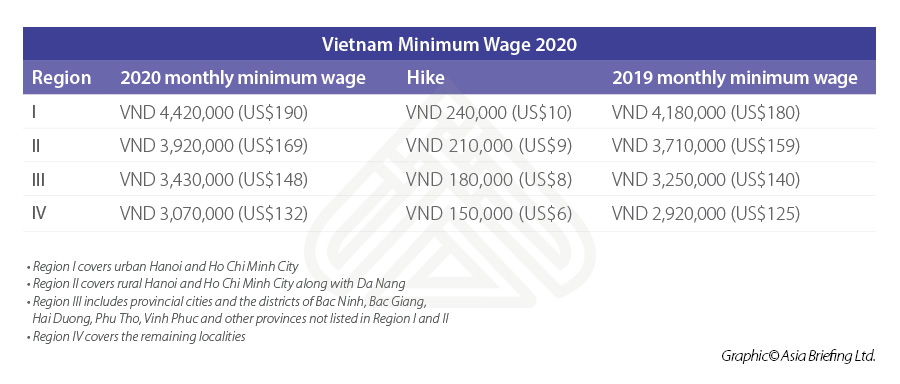

The monthly minimum wage rate was increased by 5.7 percent from January 1, 2020, higher than the 2019 hike of 5.3 percent. The country sets a different minimum wage level across its four regions. As a result of the new increase, Region I (Urban Hanoi and Ho Chi Minh City) registered the highest minimum wage of VND 4,200,000 (US$190) while Region IV was the lowest with VND 3,070,000 (US$132). Employees that have had vocational training must be paid at least seven percent higher than the applicable minimum wage rate. The minimum wage rates are as below:

Our specific Vietnam Briefing website has further references to the business environment in the country. We covered foreign investment establishment options in Vietnam in our complimentary Guide Doing Business In Vietnam 2021.

Alternative Asia

Then there are another three additional markets that might be suitable for companies looking to exit Myanmar:

Bangladesh

In recent decades, Bangladesh has emerged as a powerhouse for apparel manufacturing. The country’s strengths are its low labor cost and huge available workforce. Advanced technology and high-quality products have attracted many major global retail brands to Bangladesh, leading it to become the world’s third largest textile exporter. The vertical capacities of Bangladesh is now helping manufacturers obtain more transparency and coordination in their supply chain.

There are regional problems in the border area between Myanmar and Bangladesh, and the entire border is closed. There are signs that this may change however, in December 2020, and as part of the development of the Chattogram Hill Tracts (CHT), the two Government had planned to establish a land port at Ghungdoom of Naikhongchhari in Bandarban on Bangladesh-Myanmar border.

Construction of a 1,036km-long ‘Border Road’ along the three hilly districts — Rangamati, Khagrachhari and Bandarban has also commenced, Ghungdoom to Cox’s Bazar as well as plans being made to build a railway to the Ghungdoom border with Myanmar for promoting trade. Myanmar exports would include essential commodities, such as wood, fish, dry fish and betel nut, while Bangladesh exports would include generic medicines and garments through the proposed land port.

Bangladesh has a growing network of Free Trade Agreements, including in Asia with China, India, Nepal, Pakistan, Sri Lanka, Thailand in addition to Turkey and Brazil. It has preferential export rates in garments with the UK, EU and United States. The minimum wage in Bangladesh is US$103 pcm.

Dezan Shira & Associates has a partner firm in Bangladesh. Please contact us at bangladesh@dezshira.com for assistance.

India

India has Free Trade Agreements with ASEAN the Gulf Cooperation Council, Bangladesh, Japan, Malaysia, Pakistan, Singapore, Sri Lanka, and South Korea and is actively pursuing others. It has Preferential Trade Agreements in Asia with Afghanistan, the South American Free Trade Bloc Mercosur, upgraded its bilateral trade relationship with the UK last week and has also been upgrading trade agreements with the EU. Significant Trade deals are also pending with Australia, Canada, Egypt, Indonesia, Iran, Israel, Philippines, Southern Africa, Russia, and Turkey. Clearly, India is gearing itself up to be a far more open market than previously – although there is still some way to go. It is also a massive domestic market with a middle-class consumer base of some 400 million and huge industries in multiple sectors. Our India-Briefing website refers.

India has a huge workforce, although the minimum wage and related employment issues are complex and vary from state to state. The national minimum wage is just US$62 per month, however regional variations are considerable. It is a subject we discussed in the article Minimum Wages In India 2021.

Myanmar shares a long land border of over 1600 Km with India as well as a maritime boundary in the Bay of Bengal. Myanmar’s border with India rubs up against four North-Eastern Indian States: Arunachal Pradesh, Nagaland, Manipur and Mizoram. There are designated border and immigration crossings at Tamu in Myanmar to Moreh in India and the Zorinpui International border crossing in Mizoram.

We covered foreign investment establishment options in India in our complimentary Guide Doing Business In India 2021. Our India Briefing website is also a useful resource.

China

Many foreign invested businesses in Myanmar will be well aware of the importance of China in the region, however the border areas of China are well worthy of consideration, with recent new developments last year enhancing their capabilities as manufacturing and export hubs. China has a Free Trade Agreement with ASEAN, although there have been recent trade tensions with the United States, which may negate interest from US manufacturers. However, China has recently signed off an upgraded deal with the EU and is also part of the RCEP Free Trade Agreement which additionally includes Australia, Japan, New Zealand and South Korea. A pending deal on tariff reduction with Russia via the Eurasian Economic Union is also on the cards.

Myanmar’s border with China runs along the western side of Yunnan Province, ranging from high mountains to the tropical plans of the south. There are numerous border crossings between the two, in what are principally agricultural based economies.

However, last year China introduced new laws to expressly develop cross-border trade on a national basis, and targeted border areas including the Dihong Dai & Jingpo Autonomous Region, which borders Myanmar’s Kachin State. Dihong Dai is a significant coffee growing area and a jade processing centre. Access is across the border crossing at Lweje. Typical exports to China include fruit, beans, rice and onions, while electronics, textiles and agricultural produce are imported to Myanmar.

The introduction of a policy to develop China’s Çross-Border E-Commerce Zones is likely to expand this trade into other sectors. The Dehong Dai Zone now provides preferential tax policies, such as exemption of VAT, Consumption Tax on Retail Exports and reduction of Corporate Income Tax Rates. These are specifically targeted at China-Myanmar bilateral trade. Further details of these incentives can be seen in our articles here and here.

Our 2020 Guide to Minimum Wages in China can be seen here, at present there has been no revising of these guidelines. Mandatory social security payments in China generally add about another 50% of top of salary.

Our complimentary Guide ‘Doing Business In China 2021’ can be downloaded here: Our China Briefing website also refers.

The important thing to note for businesses currently based in Myanmar is that there are options, and this is a good thing. Our overview above should provide some basics as to what these might be depending on your particular area of business and target markets.

Following a decision to exit, or maybe hedge some manufacturing or production elsewhere, it may be pertinent to close your business in Myanmar. We can briefly examine that option here:

Closing A Business In Myanmar

Section 162 of the Myanmar Companies Act sets out the criteria of winding up a company in Myanmar, which includes Voluntary Liquidation and Court Supervised Liquidation. This article by the Law Firm Charlton’s is an excellent introduction to the subject: Winding Up A Company In Myanmar.

Summary

Each of the options provided have merits, depending upon the activities of your particular business and business model. The low-cost manufacturing base that Myanmar provides can be replicated elsewhere, while the Free Trade benefits of being based in ASEAN can also be duplicated. Bangladesh, China and India also provide specific trade benefits – and some downsides – that are particular to them. For assistance with corporate downsizing, restructuring or relocations of businesses throughout Asia, please contact us at asia@dezshira.com