Thailand in 2017: a Changing Investment Landscape

By Harry Handley

2016 was a challenging year for Thailand, both economically and socially. The death of the much-loved King, His Majesty Bhumibol Adulyadej, clouded a year also blighted by political instability, water shortages, and bearish domestic business sentiment. Although official figures have yet to be released, Thailand’s GDP growth for 2016 is expected to be 3.2 percent, the third lowest in the ASEAN bloc (after Brunei and Singapore).

2016 was a challenging year for Thailand, both economically and socially. The death of the much-loved King, His Majesty Bhumibol Adulyadej, clouded a year also blighted by political instability, water shortages, and bearish domestic business sentiment. Although official figures have yet to be released, Thailand’s GDP growth for 2016 is expected to be 3.2 percent, the third lowest in the ASEAN bloc (after Brunei and Singapore).

Despite low business confidence from locals, foreign businesses continue to be attracted by Thailand’s strategic position between China and India, access to the ASEAN free trade area, and the incentives offered by the Board of Investment (BOI). 2017 has been touted by some as a pivotal year for the Thai economy and ‘the year of concrete national reform’, with a major election on the horizon, either at the end of 2017 or the beginning of 2018 dependent of the progress of the royal succession. As such, it is important to review the state of the market at present and identify the key factors that may affect foreign businesses, both incumbents and potential entrants, in Thailand in 2017.

![]() RELATED: Pre-Investment and Market Entry Advisory from Dezan Shira & Associates

RELATED: Pre-Investment and Market Entry Advisory from Dezan Shira & Associates

2016 import, export, and FDI trends

Thailand has become increasingly reliant on exports in recent years, with net exports reaching a record high in 2016. Thailand’s top five trading partners can be seen in the table below. Electronics were the main exported product, making up 14.6 percent of the total. This was followed by automotive goods (13.9 percent), agro-manufacturing products (11.9 percent), petrochemical products (5.8 percent), and electrical appliances (5.4 percent). In terms of imports, mineral fuel and lubricant made up the largest percentage (22 percent). Machinery, equipment, and supplies (19.5 percent), parts of electronic and electrical appliances (11.5 percent), materials of base metal (8.6 percent), and chemicals (5.8 percent) made up the top five.

FDI investment applications exceeded the BOI’s targets in 2016, totaling THB 584 billion. Of these applications, 925 projects were approved, bringing total foreign investment of THB 358 billion. 64 percent of the approved applications (594 projects) were for 100 percent foreign-owned projects, the remainder being made up by franchising agreements as well as mergers and acquisitions.

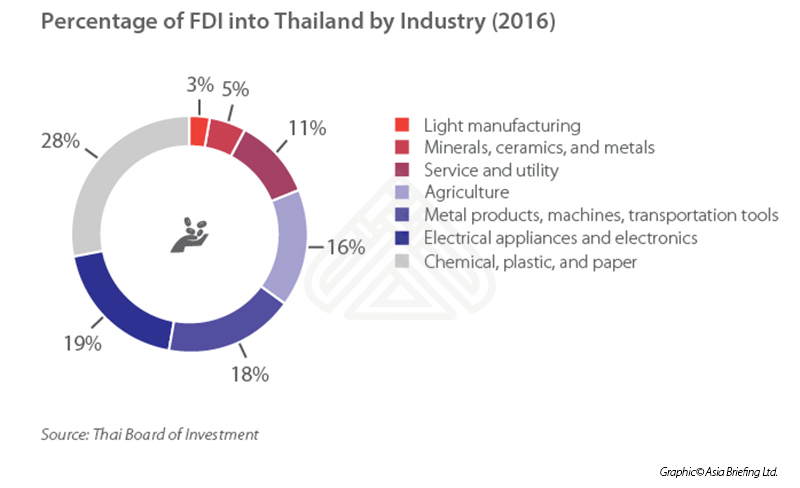

Japan was the leading country of origin of FDI into Thailand; 284 projects contributed THB 80 billion of FDI in 2016. The main driver for this is the automotive industry, with Toyota, Isuzu, Nissan, and Honda all having considerable manufacturing and assembly operations in Thailand. The second largest foreign investor was China, which contributed THB 54 billion in 106 projects last year. The top five was rounded off by the Netherlands (THB 29 billion), the US (THB 25 billion), and Australia (THB 20 billion). The breakdown of FDI by industry can be seen in the graph below.

2017 outlook

Thailand’s GDP growth is expected to remain consistent in 2017, with forecasts ranging from 3-3.6 percent. BMI’s 2017 risk report ranks Thailand the 21st least economically risky market globally and 8th in Asia Pacific, in the short-term. Longer term risk is seen to be slightly higher, demonstrated by a rank of 27th in the world. The overarching risk factor for the Thai economy is political instability. In response to this, the incumbent military government has presented an ambitious plan to end this uncertainty and move Thailand towards a high income economy.

Thailand 4.0

Leading analysts define Thailand 4.0 as ‘a transformed Thailand that maximizes the use of digital technologies in all social-economic activities in order to develop infrastructure, innovation, data, human capital, and other digital resources that will ultimately drive the country towards wealth, stability, and sustainability’. In 2017, there will be four main areas of focus and investment:

- The digital economy – primarily improving national broadband network; goal is for all Thais to have access to broadband by 2026

- Physical infrastructure – including the initiation of construction on the Thai-China high speed rail link

- Agricultural reform – namely, the ‘Smart Farmer’ project

- Local economic development – 18 provincial clusters used to target developmental policies, including minimum wage policies

As part of the Thailand 4.0 promotion, the Commerce Ministry’s Business Development Department has sought Cabinet approval for a new law that will allow individuals to establish a company singlehandedly. This move will formalize around 2.74 million SMEs in Thailand that have previously been set up as ‘sole proprietorships’ without legal separation of company and personal assets. It has yet to be confirmed whether this law will also apply to foreign entrepreneurs; if this is the case, it will ease the process of starting an SME in Thailand and remove a number of barriers for foreign businesspersons. However, it is unclear how this new policy would fit into the guidelines of the current Foreign Business Act, which governs foreign owned enterprises in Thailand.

BOI incentivized industries

The BOI also has a significant role to play in the realization of Thailand 4.0. As well as investing in human resources to attract the best regional and global talent, the BOI offers significant incentives to foreign entrants in a number of industries. These include ‘S-Curve’ industries (e.g. next-generation automotive, biotechnology, and smart electronics), core technologies (e.g. digital, biofuels, and logistics), and community enterprises. Upon approval, entrants in these industries are offered the following tax breaks:

- Eight year Corporate Income Tax exemption

- 50 percent tax reduction for five years after the tax holiday

- Double deduction from the costs of transport, electricity, and water supply

- 25 percent deduction on the cost of installation or construction of facilities as well as exemption of import duty on raw or essential materials imported for use in production for export

Other key industries

Thailand is synonymous with the tourism industry. In 2016, 32.6 million foreign tourists visited Thailand. The flow of tourists was stunted at the end of 2016 by the passing the King, and this will also carry over into 2017 as the official period of mourning continues. However, towards the end of 2017 when the mourning period is over, Thai officials expect to see a boom in the tourism industry once again, with tourist arrivals forecasted to be 37 million. This will be boosted by an ever weakening baht, making it cheaper for overseas travelers to visit Thailand. As such, all of the industries related to tourism, including hospitality, food service, and recreational activities will once again be prime targets for potential investors.

As mentioned, agricultural reform is one of four focus areas for the Thai government in 2017. Consequently, it is expected that incentives will be put in place for agricultural technology firms who can support the growth and development of this industry and the ‘smart farmer’ project.

Finally, Thailand’s membership to the ASEAN economic community and free trade area, and developed infrastructure make it an ideal base for import/export enterprises. The recent introduction of the e-Customs system, an online system that centralizes all customs and licensing procedures, and promotion of export processing zones further reduce the costs of running a cross-border trading operation in Thailand.

![]() RELATED: Electrifying Laos: Opportunities for FDI in 2017

RELATED: Electrifying Laos: Opportunities for FDI in 2017

Challenges and opportunities

The World Bank’s Doing Business Guide ranked Thailand 46th in the world for ease of doing business. Particularly difficult aspects of doing business include starting a business (78th), getting credit (82nd), and paying taxes (109th). Combine this with the ever-present political instability and a shortage of skilled workers and Thailand begins to appear as a risky and troublesome option for potential investors.

However, in order to counteract this, the Thai government and BOI have introduced a number of pro-FDI policies. Recently, restrictions for foreign entrants have been eased in a number of industries, including insurance and commercial banking. There are plans to extend the business license waiver to more service industries. Add to this the strong geographic location of Thailand and the THB 1.4 trillion of planned infrastructure spending, and the future of Thailand as an investment location looks bright.

Ultimately, 2017 is being seen as a year of transition for Thailand; the new King Maha Vajiralongkorn will be crowned and the junta government will begin the process of reinstating their own brand of democracy to the nation. The military-written constitution, passed with 60 percent support in a 2016 referendum, suggests that despite the army’s desire for ‘democracy’, their influence will be entrenched in Thai politics regardless of the result of the upcoming election. Consequently, it is expected that investment growth will be tentative throughout the year with many potential entrants holding off to see how the major events later in the year pan out.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Dezan Shira & Associates Brochure

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in ASEAN 2016

An Introduction to Doing Business in ASEAN 2016

An Introduction to Doing Business in ASEAN 2016 introduces the fundamentals of investing in the 10-nation ASEAN bloc, concentrating on economics, trade, corporate establishment and taxation. We also include the latest development news in our “Important Updates” section for each country, with the intent to provide an executive assessment of the varying component parts of ASEAN, assessing each member state and providing the most up-to-date economic and demographic data on each.

Human Resources in ASEAN

Human Resources in ASEAN

In this issue of ASEAN Briefing, we discuss the prevailing structure of ASEAN’s labor markets and outline key considerations regarding wages and compliance at all levels of the value chain. We highlight comparative sentiment on labor markets within the region, showcase differences in cost and compliance between markets, and provide insight on the state of statutory social insurance obligations throughout the bloc.