Understanding Labuan’s New Tax Framework

- Labuan, a federal territory of Malaysia, issued a new tax framework in early 2019, which impacts a variety of tax requirements, such as the abolition of the 20,000-ringgit (US$4,914) tax ceiling.

- The Labuan International Business and Financial Centre (IBFC), the entity managing Labuan, hopes these changes will increase the region’s business competitiveness.

- Other significant changes include the requirement of economic substance for Labuan entities, which involves employing full-time employees and minimum annual spending.

Labuan is a federal territory of Malaysia comprising of seven small islands located off the coast of Sabah in East Malaysia. Its capital, Victoria, is a well-known offshore financial center, offering a variety of financial and business services through the Labuan International Business and Financial Centre (IBFC) — a special economic zone.

International businesses are attracted to Labuan’s favorable tax structure for non-residents and business-friendly environment, making the territory one of the preferred destinations for offshore company formation. Moreover, Labuan is strategically located near Asia’s main financial and business hubs of Singapore and Hong Kong, in addition to access to the fast-growing regions of ASEAN.During 2019, the IBFC saw 981 new company incorporations, with 58 percent originating from the Asia-Pacific region. Further, the IBFC implemented the new Labuan IBFC tax framework in early 2019 to comply with the Organization for Economic Co-operation and Development’s (OECD) international tax standards.

Features of Labuan’s new tax framework

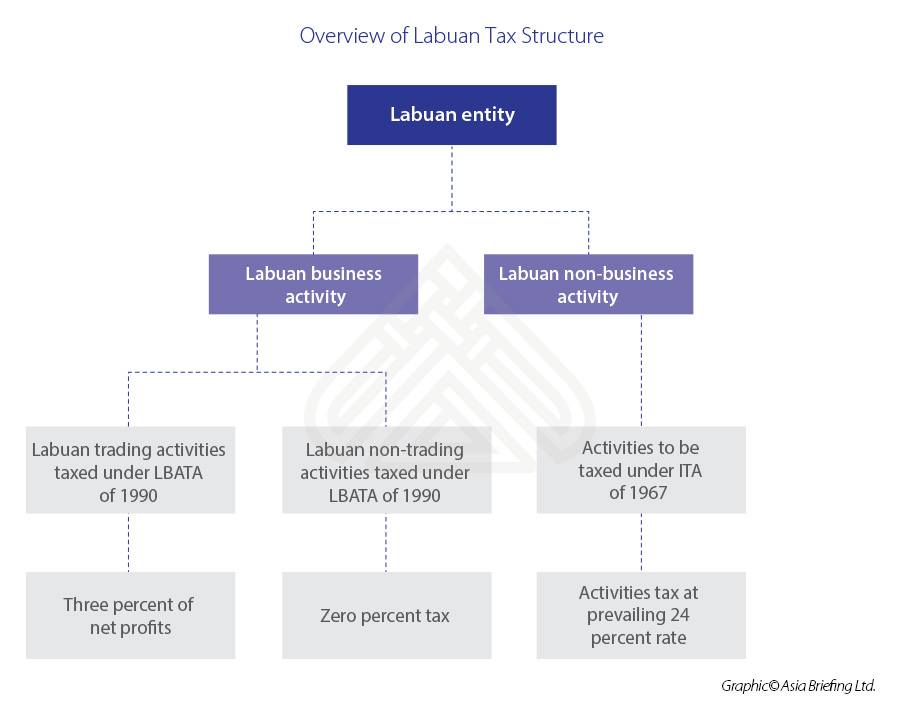

The IBFC introduced a new tax framework, also known as the Labuan Business Activity Tax Act, 1990 (LBATA), in 2019 to address elements of harmful tax practices that hindered the competitiveness of Labuan IBFC.

The revised framework contains the following:

- The abolition of the flat tax rate – a Labuan taxpayer undertaking ‘Labuan trading activities’ can no longer elect to pay tax at the 20,000 ringgit (US$4,914) tax ceiling. Instead, the tax rate will be fixed at three percent on net profits from Labuan’s business activities. Businesses undertaking ‘Labuan non-trading activities’ continue to be exempt from tax under LBATA regulations.

- Labuan entities can now undertake a Labuan ‘business activity’ with Malaysian residents and using the ringgit currency, whereas previously, business activities could only be done in, from, or through Labuan, utilizing a foreign currency and with a non-resident/Labuan entity.

- Malaysian entities making transactions with a Labuan entity are now entitled to an income tax deduction on any expenditure that occurred, although this is limited to a rate of three percent.

- Any income incurred from intellectual property rights is now subject to tax under the Malaysian Income Tax Act, 1967 (ITA), instead of the (LBATA). This means the new prevailing tax rate is 24 percent.

- Prior to the changes, Malaysian taxpayers could claim a 100 percent tax deduction on payments made to a Labuan entity. Business entities can now only claim partial tax deductions with the maximum deductions as follows:

- Interest payments — 67 percent;

- Lease rentals — 67 percent; and

- Other payment types — three percent.

Businesses should note that Labuan trading activities include:

- Trading;

- Management;

- Insurance;

- Banking;

- Shipping; or

- Operations that are not classified as Labuan non-trading activities.

Labuan non-trading activities are related to investments in:

- Shares;

- Loans;

- Deposits;

- Stocks; or

- Securities.

New substance requirements for Labuan entities

Labuan entities are now required to fulfill criteria related to ‘economic substance’ (substance over form). This accounting principle ensures that financial statements provide an accurate view of all transactions. This also prevents artificial business structures from being used for tax avoidance.

The LBATA requires businesses undertaking Labuan business activities to have between a minimum number of full-time employees and annual spending. These are:

- Labuan holding companies undertaking purely equity holding activities do not require any full-time employees but must have a minimum of 20,000 ringgit (US$4,914) in annual expenditure;

- Labuan holding companies undertaking other than pure holding activities require one full-time employee and have a minimum of 20,000 ringgit (US$4,914) in annual expenditure; and

- Labuan companies that undertake legal, accounting, and administrative services, such as payroll services, management services, and agency services, among others, must hire two full-time employees and have a minimum of 50,000 ringgit (US$12,285) in annual expenditure.

Taking advantage of Labuan’s DTA network

Labuan entities enjoy all the double tax avoidance (DTA) benefits of Malaysia, which spans over 70 countries.

The withholding tax rate is only subject to non-residents in Malaysia. Dividends are subject to a zero percent withholding tax and interest paid to non-resident companies are subject to a 15 percent tax rate. Royalties are subject to a 10 percent withholding tax.

There are exceptions, with 11 countries not recognizing Labuan as part of Malaysia because of its status as an IBFC, and thus the DTA does not apply in these cases. The countries are:

- Australia;

- Chile;

- Germany;

- Indonesia;

- India;

- Japan;

- Luxembourg;

- The Netherlands;

- Seychelles;

- South Africa;

- South Korea;

- Spain;

- Sweden; and

- UK

Labuan companies wishing to benefit from DTAs from the aforementioned 14 countries can do so by applying to be taxed under the ITA, in which net profits would be taxed at 24 percent.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City and Jakarta. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Thailand Issues Tax Incentives for Electric Vehicle Industry

- Next Article Myanmar’s Tax Relief for Businesses Impacted by COVID-19