Taking Advantage of Singapore’s Double Tax Agreement and Free Trade Networks

Singapore has one of the world’s most extensive DTA and FTA networks and why the country attracts businesses from many nuanced industries.

Singapore’s double tax agreement network

Singapore has one of the world’s most extensive double tax agreement (DTA) networks, attracting international businesses from many conventional and nuanced industries. The country has signed over 90 DTAs, which comprise three types: comprehensive, limited, and exchange of information arrangements (EOIAs).

Comprehensive DTAs provide relief from double tax for all income types between the two signatories. Limited DTAs, however, only provide relief from income generated from air transport and shipping, and EOIAs are provisions for the exchange of tax information.

The tax reliefs under each DTA treaty differ for each country. They normally cover several income types:

- Tax on royalties;

- Tax on dividends;

- Tax on capital gains;

- Tax on interests;

- Shipping and air transport;

- Directors’ fees;

- Independent and dependent personal services;

- Researchers;

- Students; and

- Income from immovable property.

How to avail the benefits of a Singapore DTA

To benefit from Singapore’s extensive network of DTA’s, the individual or company must be a tax resident of Singapore or the other country.

A Singapore resident is defined as:

- A company or body of persons whose control and management of the business I exercised in Singapore; or

- An individual who resides in Singapore except for such temporary absences therefrom as may be reasonable and not inconsistent with a claim by such individual to be a resident in Singapore and includes an individual who is physically present or who exercises employment in Singapore for 183 days or more in a calendar year.

The Singapore resident must submit proof of their Singapore tax residency — a certificate of residence (COR) — to the other treaty country. If, however, the company is a tax resident of the treaty country, it will need to submit a completed Certificate of Residence from Non-Residents certified by the tax authority of the treaty country to the Inland Revenue Authority of Singapore.

Within Singapore, a COR is used to establish a company’s eligibility for exemption on taxation of profits remitted from foreign operations in the form of foreign branch profits, dividends, and other foreign-sourced income. Without a COR, these remitted profits would be subject to the same manner that any other profits would be within the country.

Case study: Routing investments through Singapore

To illustrate the benefits of a DTA, let’s take the case study of a Chilean investment in Indonesia remitting their profits through Singapore.

If the investors were to execute a direct remittance to Chile, they would be subject to Indonesia’s CIT rate of 22 percent in addition to a 20 percent withholding tax (WHT) rate applied to dividends, interest,

and royalties, due to Indonesia and Chile not having a DTA. Thus, the realized profit is only 62.4 percent of total gross income.

When routing the same investment through Singapore, investors would be subject to the same CIT rate but benefit from Singapore’s DTA with Indonesia which reduces withholdings on all fronts. Singapore’s DTA with Indonesia means that dividends from Indonesia are taxed at 10 percent while there is no tax on dividends under the Singapore-Chile DTA. The realized profit is, therefore, higher compared to the direct remittance to Chile.

Singapore’s Free Trade Agreements

Despite regional players maintaining strong FTA networks, they are not as extensive as Singapore’s. Due to these factors, the country will continue to be the default location for businesses seeking to expand into Southeast Asia and neighboring regions.

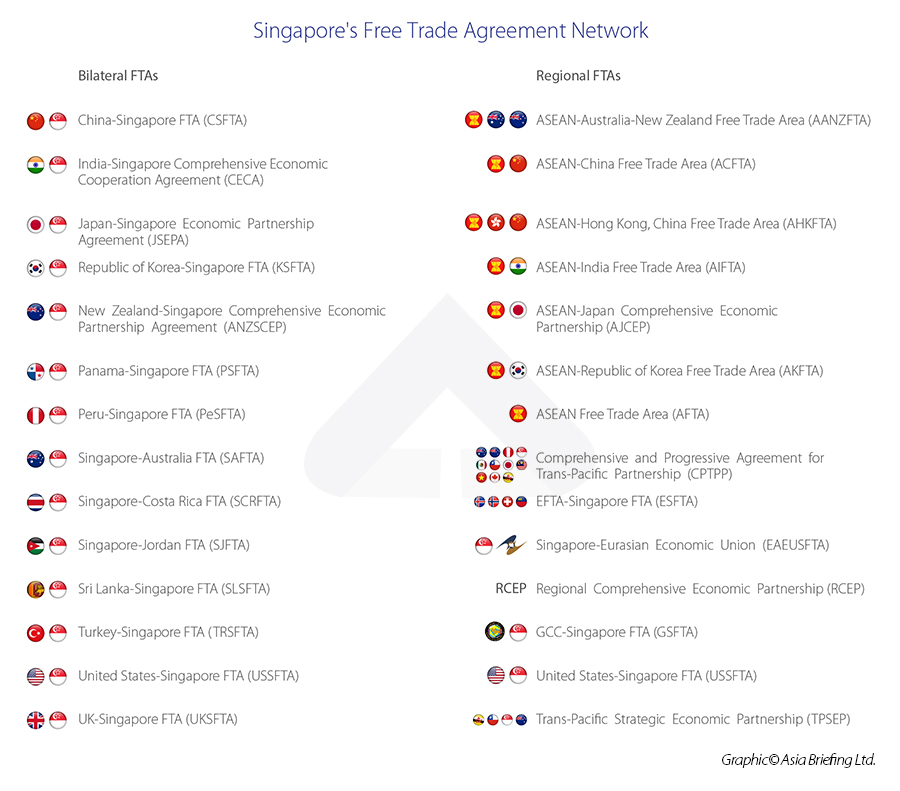

The country’s 14 bilateral and 13 regional FTAs include some of the largest combined trade agreements in the ASEAN-China, ASEAN-India, and ASEAN-Hong Kong trade blocs — providing Singapore-based businesses with access to preferential markets, free or reduced import tariffs, as well as enhanced intellectual property regulations.

There are two types of FTAs: bilateral (agreements between Singapore and a single trading partner) and regional (signed between Singapore and a group of trading partners).

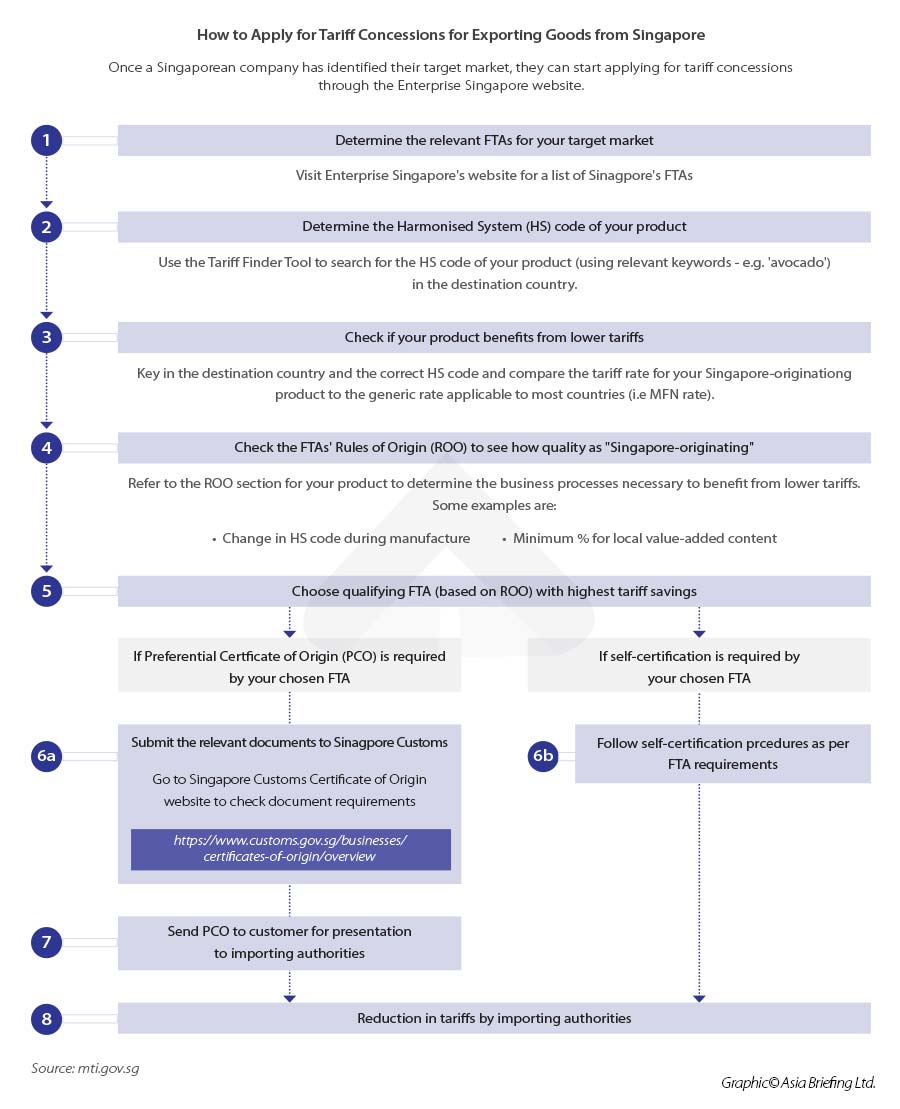

How to apply for tariff concessions for exporting goods from Singapore

Once a Singaporean company has identified its target market, it can start applying for tariff concessions through the Enterprise Singapore website.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Essen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia. We also have partner firms in Malaysia, Bangladesh, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.

- Previous Article US Exempts Tariffs on Vietnamese Solar Panels for Two Years

- Next Article Changes to Merger and Acquisition Rules in Malaysia