Myanmar’s 2020 Union Taxation Law: Salient Features

- Myanmar’s government introduced the 2020 Union Taxation Law (UTL) on September 2, which sets out the latest rates for income tax, gemstone tax, commercial tax, and specific goods tax.

- The major changes in UTL 2020 are the increased tax rates of undisclosed sources of income.

- Businesses should seek the assistance of local tax advisors to ensure they stay compliant.

Myanmar’s government issued the 2020 Union Taxation Law (UTL) on September 2, 2020, which provides the latest rates for commercial tax, specific goods tax, gemstone tax, and income tax. The UTL will be applicable for 2020 to 2021 financial year (October 1, 2020, to September 30, 2021).

Under the 2019 UTL, the government introduced a tax amnesty for citizens with undisclosed sources of income; this tax amnesty is set to expire on September 30, 2020. UTL has increased the tax rates for such undisclosed incomes under the 2020 UTL to ease the impact on businesses caused by the COVID-19 pandemic.Businesses should seek the assistance of local tax advisors to ensure they stay compliant with the new law.

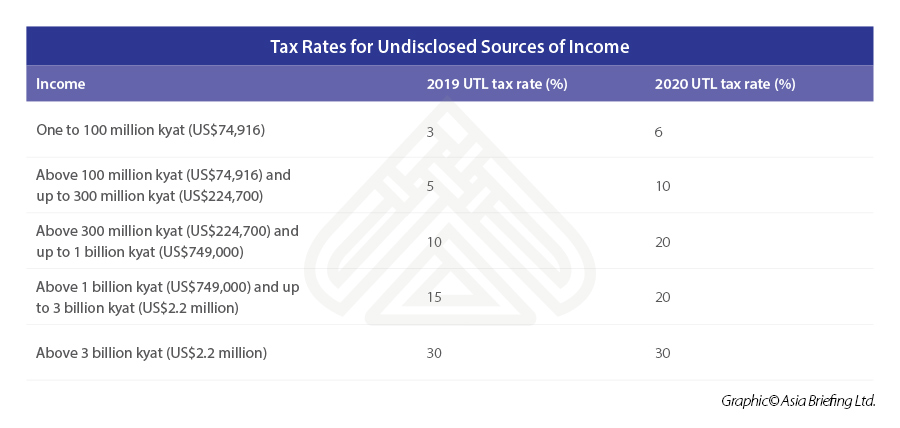

Tax increases for undisclosed sources of income

Under UTL 2020, corporate income tax rates, personal income tax rates, and capital gains remain the same from the previous year.

There is, however, an increase in the tax rates for undisclosed sources of income – for citizens who cannot show evidence of the source of income used for buying and/or constructing any assets.

Commercial tax

The commercial tax (CT) rate for general goods and services remains at five percent. There is no CT on the sales of goods or receipts from services that do not exceed 50 million kyat (US$37,700), and there is no CT imposed on exports, except for the export of electricity (taxed at eight percent) and crude oil (five percent).

There are 43 types of goods and 33 types of services that are exempt from CT. Under UTL 2020, CT is now exempted on soymilk, but other non-dairy products are subject to CT. Moreover, any goods imported or purchased locally under the name of a UN organization are also exempt from CT.

Services procured locally under the name of a UN organization are exempt from CT in addition to air transport services for domestic and foreign passenger trips.

New specific goods tax rates

The UTL 2020 introduces higher specific goods tax (SGT) rates for cigarette products.

Cigarettes

Gemstone tax and income tax

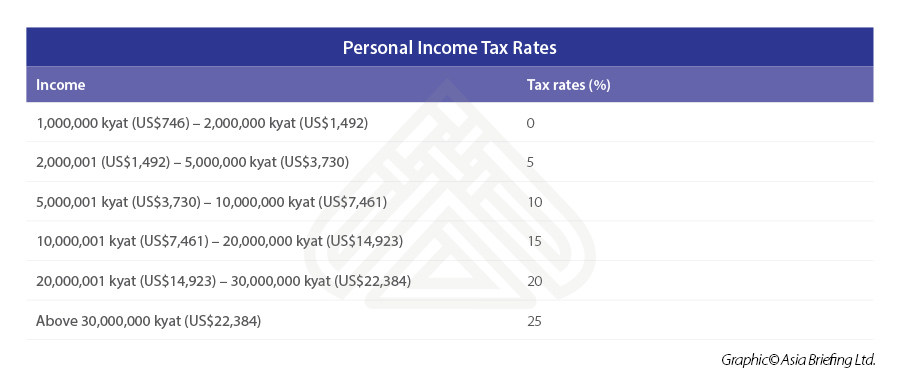

There are no changes to the gemstone tax and income tax.

Under the Myanmar Income Tax Act, residents are taxed on their worldwide income whereas non-residents are taxed only on income derived from Myanmar.

Foreigners who reside in Myanmar for at least 183 days are considered resident foreigners.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City and Jakarta. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.