Sparking Excitement: Investment Opportunities in ASEAN’s Electronics Industry

By: Maxfield Brown

Conditions are ripe for investment in ASEAN electronics production. Global demand has risen by an average of nine percent over the past five years, and the impending completion of the ASEAN Economic Community (AEC) and Trans Pacific Partnership (TPP) promise to solidify the region’s growing share of global exports – currently standing at 13 percent. The simultaneous integration of regional value chains and easing of trade restrictions with traditional partners provides a unique opportunity to leverage the regions diverse range of economies. The following industry brief highlights key productions locations and opportunities for growth within the regional bloc.

The Electronics Value Chain

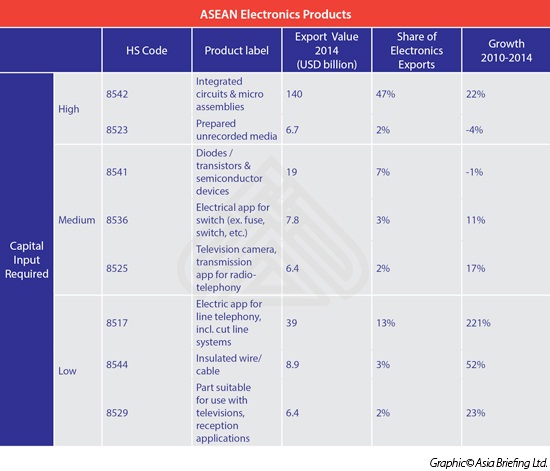

With developed and developing members, ASEAN is host to production in both capital and labor intensive stages of electronics manufacturing. The strong growth of a wide variety of industry sub-groupings – ranging from integrated circuit assembly to insulated wiring – underscores the successful manner in which many aspects of production can operate simultaneously. In addition to providing isolated investment opportunities, recent progress towards a common market has increased the regions capacity for integrated production lines.

RELATED: Grounds for Investment: Opportunities in Southeast Asia’s Coffee Industry

RELATED: Grounds for Investment: Opportunities in Southeast Asia’s Coffee Industry

As of 2014, capital intensive electronics production accounted for the majority of ASEAN exports. Key industries such as integrated circuits and micro assemblies have seen strong growth and provide opportunities for scaling in the coming years. Alternatively, production lines with intermediate capital requirements are seen to be in the process of reorientation. Traditionally dominant lines of production have seen growth slowing in the face of more competitive alternatives such television camera and radio receiver components. Although making up a smaller portion of ASEAN exports, labor intensive segments of electronics production – such as insulated wire manufacturing – have seen explosive growth in recent years and present new investment opportunities in several key markets.

Traditional Importing Markets

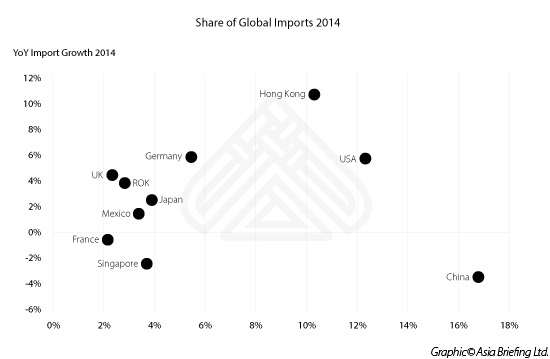

Global demand for electronics presents investors with a diverse range of export destinations and allows investments to be tailored to the existing exposure of individual investors. Although ASEAN’s growing consumer base and integrating value chains present future sources of demand, the majority of electronics importers are located outside of the region. As of 2014 China held the largest share of electronics imports, purchasing 17 percent of ASEAN electronics. While import declines from the Asia’s largest economy should be watched closely, increasing consumption from western markets has been more than sufficient to provide net demand growth in recent years. Key importing markets such as the United States and Germany have become increasingly important with imports advancing five and six percent respectively in 2014.

Regional Production Opportunities

Although the AEC has made great strides in harmonizing trade and production within ASEAN, remaining distinctions between markets are large and warrant careful review when considering investment. Distribution of electronics production is spread across the regional bloc with substantial production hubs in Singapore, Malaysia, and Vietnam. Representing a diverse range of economies, each production location provides a different set of industries primed for investment, levels of exposure to international trade, and of opportunities for future growth.

Singapore

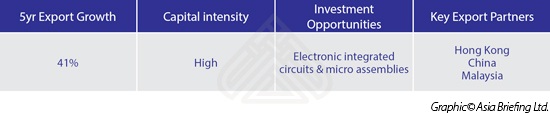

Famous for its business friendly policies, infrastructure, and highly educated workforce, Singapore has long been the home of capital intensive electronics production within ASEAN. In 2014 total electronics exports reached US $124 billion, amounting to 45 percent of ASEAN’s electronics sales and 30 percent of the city states’ total exports. Key trading partners include Hong Kong, China, and Malaysia which import more complex components that can be assembled into finalized products. This position has become more pronounced in recent years with strong growth in several of Singapore’s most important product lines such as Integrated circuits and Micro Assemblies.

With productivity growing throughout the region and many alternative markets offering relatively cheaper labor costs, success in Singapore will increasingly be defined by innovation and production at the highest levels of the value chain. Trade agreements such as the RCEP are likely to provide increased access to export destinations through reductions of non-tariff barriers with key markets such as China. Furthermore, as barriers to trade decrease, Singapore will be able to further leverage its competitive taxation. This will be particularly pronounced within the AEC as Singapore is likely to find increased demand for components in growing assembly hubs in Malaysia, Vietnam, and others.

Malaysia

Malaysia has emerged as an intermediate market catering to capital intensive producers seeking to cut costs, as well as labor intensive lines of production working to improve productivity. Growing by 45 percent over the last five years, electronics have become an important export for the Malaysian economy – constituting 32.9 percent of total exports in 2014.

As Malaysia’s position as a low cost production location for high value added components becomes more pronounced, semiconductor production presents an increasingly lucrative investment opportunity. Since 2009, the entrance of major (MNCs) and such as Intel, AMD and Texas Instruments, and investments of Malaysian-owned companies such as Silterra, Globetronics, and Unisem have contributed to a 64 percent increase in semiconductor exports. To date, there are more than 50 companies have established semiconductor production within Malaysia with exports reaching US $7.8 billion in 2014.

Key export destinations include Singapore, the United States, and China and are likely to facilitate balanced demand for Malaysian goods reducing exposure to asymmetric shocks. In addition to shielding investors from risk, existing trading partnerships position Malaysia to capitalize on future trade agreements such the TPP and regional integration in the AEC.

Vietnam

As wages continue to rise in China and other assembly locations, Vietnam has emerged as a low cost alternative of choice. Joining the WTO in 2007, Vietnam has seen massive growth in electronics exports as many companies have grown more comfortable with the countries business environment. Growth has been further stimulated by supportive government policies and tax incentives that have decreased the costs of doing business within the country. The results of increased production had a direct impact on the positon of Vietnamese electronics exports within ASEAN. Between 2010 and 2014, Vietnam’s share made substantial gains increasing from three to 15 percent.

Much of Vietnamese export growth has been the result of FDI inflows from the likes of Samsung, LG, Canon and Nokia which have set up assembly lines for their products. Drawn by tax incentives and some of the largest export processing zones in ASEAN, these foreign enterprises have become a cornerstone of exports in Vietnam. As of 2014, Samsung alone accounts for around 20 percent of total Vietnamese exports.

As Vietnam continues to improve its business environment, it will likely move further up the value chain. This will increase profitability for producers and while opening up opportunities in for investment in higher end manufacturing. Increased demand from the United States and Japan is also expected as the TPP increases their access to the Vietnamese market.

RELATED: Pre-Investment Services from Dezan Shira & Associates

RELATED: Pre-Investment Services from Dezan Shira & Associates

Emerging Opportunities: Cambodia

With a recent push for investor friendly reforms and highly competitive labor costs, Cambodia provides unique opportunities for investors looking to set up low cost production operations in South East Asia. Although comprising a small percentage of total ASEAN electronics exports, the last five years have seen exponential growth in low value added electrical production. Insulated wiring has been at the forefront of this growth and Cambodia is rapidly becoming a production hub for importers in Thailand and Japan.

To leverage its position as a low cost producer, Cambodia has made significant efforts to further reduce costs and improve infrastructure. Tax holidays on profits and reductions of duties on imports used in production are available to electronics investors for a period of three years with opportunities for extensions in specific circumstances. To qualify for these incentives investments of US $300,000 or higher are required. In addition to competitive taxation policies, Cambodia is home to a number of special economic zones (SEZs) providing investors with improved infrastructure. A full list of existing SEZs is available here.

As traditional low cost producer such as Vietnam continue up the value chain in search of higher wages, Cambodia is likely to take on a larger role in the manufacturing of basic components that can be used in finalized products. Complementing the upward pressure on competitor’s wages, the inclusion of export destinations within the TPP is sure to increase demand for Cambodian exports.

Further Support from Dezan Shira and Associates

To learn more about investment in ASEAN’s electronics sector, as well as enhanced opportunities under the TPP please contact the experts from Dezan Shira & Associates at singapore@dezshira.com for more support.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

The 2015 Asia Tax Comparator

In this issue, we compare and contrast the most relevant tax laws applicable for businesses with a presence in Asia. We analyze the different tax rates of 13 jurisdictions in the region, including India, China, Hong Kong, and the 10 member states of ASEAN. We also take a look at some of the most important compliance issues that businesses should be aware of, and conclude by discussing some of the most important tax and finance concerns companies will face when entering Asia.

Tax, Accounting, and Audit in Vietnam 2014-2015

Tax, Accounting, and Audit in Vietnam 2014-2015

The first edition of Tax, Accounting, and Audit in Vietnam, published in 2014, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in Vietnam in order to effectively manage and strategically plan their Vietnam operations.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.