Philippines’ Finance Secretary Recommends 7 Percent Corporate Income Tax Cut

The Philippines’ Finance Secretary, Carlo Dominguez, has recommended a corporate income tax rate of 25 percent, reduced from the current 32 percent as part of the Government’s Comprehensive Tax Reform Program (CTRP).

Evaluating Cambodia’s Tax Reform

Cambodia’s recent tax reforms, which aim to introduce small and medium sized taxpayers into the formal economy, have been called the country’s most significant in decades. Here, we look at updated tax tiers, Tax on Profit and Tax on Salary rates, and other recent developments in Cambodia’s tax regime.

Malaysia Airport Tax Hikes Scheduled for 2017

Malaysia is set to implement a series of tax increases for both domestic and international bound flights starting in 2017. With rates confirmed, criticism and outcry from the nation’s aviation industry has been growing as many worry about the ramifications for regional aviation.

Philippine Tax Amnesty Proposed in a Bid to Increase Revenue Collection

A Philippine tax amnesty has been proposed in an effort to increase state collections and mitigate reduced revenues projected in the wake of planned corporate tax reductions. Understand the terms of the amnesty and how you may qualify for relief.

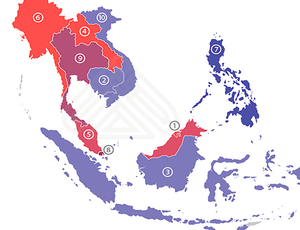

Indirect Taxation Across ASEAN

VAT and GST rates within ASEAN vary widely between member states – from 12 percent in the Philippines to countries which do not currently levy these taxes at all, such as Laos and Myanmar. For those considering investment, GST, VAT, and other taxation tied to the purchase of specific goods should be watched closely.

The Philippines Resumes Tax Audits Following Internal Review

The Philippines has announced the resumption of field audits from the Philippine Bureau of Internal revenue. Understand how the functions of the BIR have changed and what field audits will mean for your Investments.

Singapore Removes Spot Pricing Requirements for Precious Metal GST Exemptions

Investors in Investment Precious Metals (IPMs) will no longer be required to base pricing on commodity spot prices to claim exemption from GST. Understand what has changed and how the new policy is likely to impact investment.

Malaysia Announces 70% Tax Exemption for Shipping Industry

Malaysia is one of the most prolific traders within the ASEAN bloc. Helping to ensure the longevity of this position, the country has introduced a 70 percent tax incentive for those in the shipping industry. Understand the particulars of these incentives and learn how you may benefit.

An Introduction to Malaysian GST

Malaysia has introduced Goods and Service Taxation (GST) as of April 2016. Learn how this tax has been implemented and understand its projected impact on business throughout the country.

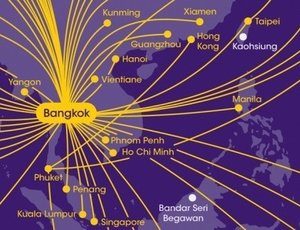

The Benefits of Regional Management in Thailand

Thailand is seeking to position itself as a regional management center within ASEAN. Read more to learn about incentives offered by the Kingdom as well requirements needed to tap into these opportunities.