Cambodia-Hong Kong DTA: Key Features

- On January 1, 2020, the double taxation avoidance (DTA) agreement between Cambodia and Hong Kong came into force.

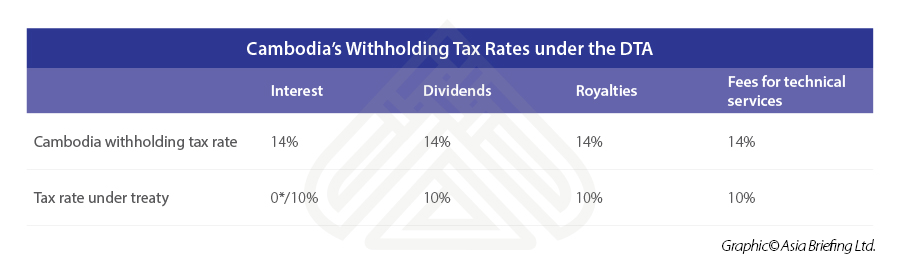

- Under the DTA, the withholding tax rate for Hong Kong residents on interest, dividends, royalties, and fees for technical services has been reduced from 14 to 10 percent.

- Hong Kong airlines operating to and from Cambodia only subject to Hong Kong taxes.

- Hong Kong-based international shipping companies eligible to receive a 50 percent deduction on income earned in Cambodia.

In June 2019, Cambodia and the Government of Hong Kong Special Administrative Region of the People’s Republic of China (Hong Kong) signed a treaty for the avoidance of double taxation (DTA) and the prevention of tax evasion. The treaty came into effect on January 1, 2020.

This agreement brings the number of DTAs signed by Cambodia to seven, and contains specific provisions that cover:

- Withholding tax rates;

- Reduced tax rates for Hong Kong-based international shipping companies; and

- Tax rates on Hong Kong airlines.

Taxpayers looking to take advantage of this DTA will need to prove to Cambodia’s General Department of Taxation that their business is undertaking real or significant economic activity in the contracting state.

Key features of the DTA

In addition to double tax avoidance, the agreement provides for the exchange of information between the two tax authorities to enforce against tax evasion, profit-shifting, and base erosion activities.

Cambodia has reduced the withholding tax rate on interest, dividends, royalties, and fees for technical services for Hong Kong residents, as seen in the table below.

*The zero percent rate applies only if the beneficial owner of the interest is the Hong Kong Monetary Authority, The Exchange Fund of Hong Kong, or the Hong Kong Government.

Furthermore, Hong Kong airlines, which operate flights to and from Cambodia will now be subject to corporation tax in Hong Kong only and Hong Kong-based international shipping companies will be eligible for a 50 percent reduction in income tax for revenue earned in Cambodia.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City and Jakarta. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com

- Previous Article Thailand Issues New Incentives for EEC

- Next Article Indonesia Unveils Stimulus Package to Combat Coronavirus Impact