ASEAN Legal and Tax Alert: Developments in Mekong Tax & Financing

By: Dezan Shira & Associates

Editor: Maxfield Brown

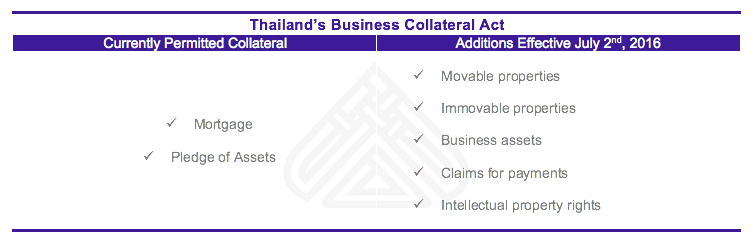

Thailand – Business Collateral Act

Starting on July 2, 2016, small and medium sized enterprises in Thailand will be provided greater access to loans within the Kingdom. As part of the Business Collateral Act, passed in November of 2015, the scope of currently available credit lines will be broadened while at the same time ensuring those providing loans with the ability mitigate increased risk exposure.

For businesses currently seeking financing, restrictions on collateral within Thailand have been a serious impediment to the acquisition of funding. Under existing laws, the only collateral options available include mortgaging under very limited circumstances or a pledge system that surrenders assets to the lender during the duration of repayment.

A major component of BCA is its expansion of collateral options to allow for companies to make better use of their assets during repayment and to give businesses a greater variety of collateral options. The chart below contrasts the current and upcoming policies:

While the BCA is sure to increase the availability of capital to growing businesses throughout the country, Dezan Shira & Associates would like to draw investors’ attention to a number of restrictions, penalties, and compliance requirements that have been placed on the financing process:

- Receiving Collateral: Financial institutions are the only actors permitted to receive collateral under the BAC.

- Business Collateral Agreements: Required for all collateral arrangements. All Agreements must be registered with the Business Collateral Registration Office.

- Preferential Claims: Pursuant to Business Collateral Agreements, those providing loans and receiving collateral shall have preferential claim over these assets. Claims will remain valid even if the assets in question have been transferred to a third party.

- Violations: any divulgence of confidential information, withholding of facts, or provision of false statements will be classified as a violation of the BCA. Punishments for these offenses can include fines and jail time of up to three years.

RELATED: International Tax Planning Services from Dezan Shira & Associates

RELATED: International Tax Planning Services from Dezan Shira & Associates

Myanmar – 2016 Union Tax Law

Myanmar’s The Union Tax Law, became effective on April 1, 2016. Passed by the national legislature, the law brings key changes to income, special commodities, and commercial taxation throughout the country.

Income tax

Under the Union Tax law, the rates for undeclared income used in the purchase, construction, or establishment of a new business; or expansion of a business will be taxed. For those considering any of these actions, the following rates will be applied to spending:

15 percent – MMK 1 to MMK 30 million (up to US $25,266)

20 percent – MMK 30,000,001 to MMK 100 million (US $25,267 to US $84,223)

30 percent – MMK 100,000,001 and above (anything beyond US $84,223)

1 USD = MMK 1187.35

In addition to the rates established above, those earning up to MMK 4.8 million ( roughly US $4,042) in declared work related income during the fiscal year 2016/2017 will be exempt from taxation.

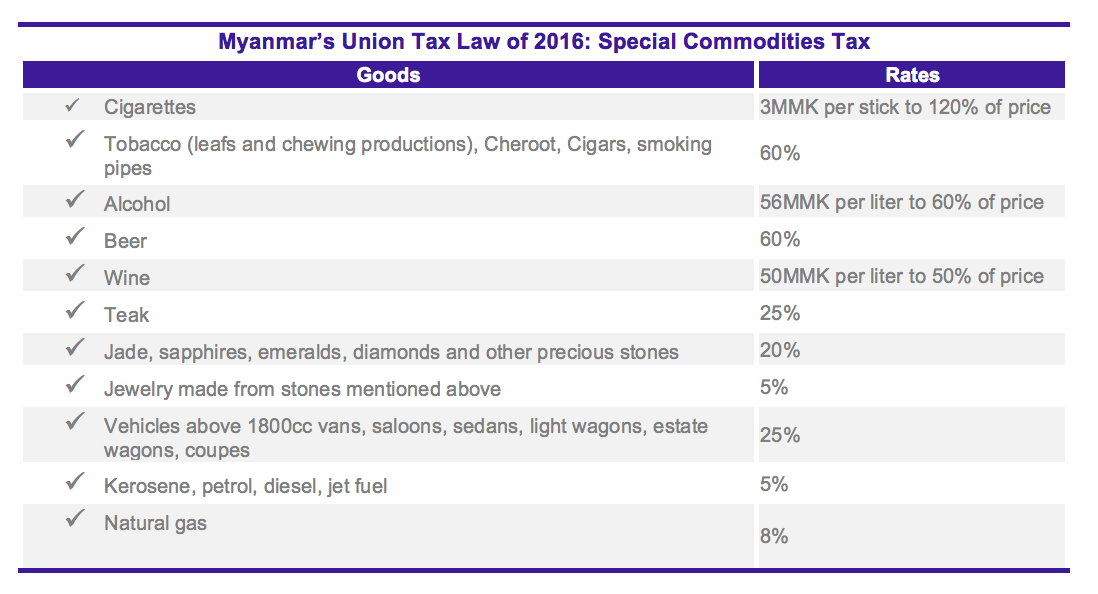

Special Commodities Tax

The Union Tax Law imposes taxes on a number of commodities in a manner consistent with special commodities taxes imposed in many countries around the world. The rates applied to each good is subject are dependent on the cost or quantity of the good being purchased.

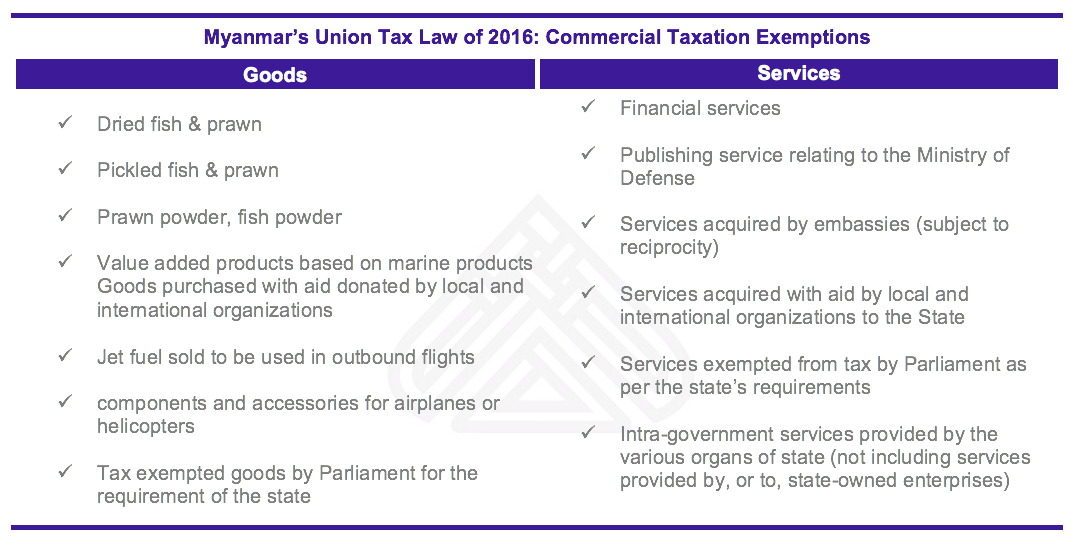

Commercial Tax

In addition to income and special commodities taxation, the Union Tax law also provides a list of goods and services that will exempt from commercial tax moving forward.

RELATED: Annual Audit and Compliance in ASEAN

RELATED: Annual Audit and Compliance in ASEAN

Cambodia – VAT Invoicing Clarification

Following a meeting between of the private sector tax working group (TWG) and senior government officials, Cambodia has issued a number of clarifications to guidance previously issued under Instruction No.1127 on VAT invoicing. Currently, VAT Invoices must be prepared for sales of goods or services through the provision of the following information:

- Name, address, and tax identification number of the seller

- Clear invoice number in a chronological order and date of issuance of the invoice;

- Name, tax identification number, and address of buyer.

- Description, quantity, and selling price of the goods or services

- Total prices excluding tax and separate tax amount

- All invoices shall be written or printed in Khmer, or both Khmer and English, and the English text shall be under the Khmer text.

As a result of the meeting, the following points of clarification have been issued with regard to VAT invoices:

Invoicing Templates: Deviation from government issued invoice templates, including the placement of logos, is permitted so long as the required information outlined above is included

Language: A six month grace period to implement Khmer language requirements will be in effect from March 24, 2016. Past the expiry of this date, English may still be used for technical terms that are not easily translated.

Claiming VAT Credit: To be eligible to claim VAT input credits, the issuer and recipient of a VAT invoice must sign and stamp the invoice.

Sequencing of VAT invoices: To be restarted at the beginning of each tax year. For businesses operating in multiple locations, it is possible to issues a separate serial number for each location. Alternatively, serial numbers can be issues centrally from a head office.

Optimizing your Tax experience in Mekong Nations

Tax and finance are likely to see continued adjustments in coming years as officials attempt to attract investment and promote sustainable growth within their economies. Those able to adapt and thrive within these conditions will be perfectly positioned to take advantage of the myriad of first mover advantages that exist throughout the region. With a team of seasoned tax professionals bringing decades of experience within the region to their work, Dezan Shira & Associates is perfectly positioned to assist companies in their quest to navigate the varied jurisdictions found within the Mekong subregion and ASEAN at large. For more information on how your business may benefit from the policies mentioned above, please get in contact with our tax professionals at asean@dezshira.com or visit us online at www.dezshira.com

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Annual Audit and Compliance in ASEAN

For the first issue of our ASEAN Briefing Magazine, we look at the different audit and compliance regulations of five of the main economies in ASEAN. We firstly focus on the accounting standards, filing processes, and requirements for Indonesia, Malaysia, Thailand and the Philippines. We then provide similar information on Singapore, and offer a closer examination of the city-state’s generous audit exemptions for small-and-medium sized enterprises.

The Trans-Pacific Partnership and its Impact on Asian Markets

The Trans-Pacific Partnership and its Impact on Asian Markets

The United States backed Trans-Pacific Partnership Agreement (TPP) includes six Asian economies – Australia, Brunei, Japan, Malaysia, Singapore and Vietnam, while Indonesia has expressed a keen willingness to join. However, the agreement’s potential impact will affect many others, not least of all China. In this issue of Asia Briefing magazine, we examine where the TPP agreement stands right now, look at the potential impact of the participating nations, as well as examine how it will affect Asian economies that have not been included.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.