Opportunities for Russian Investors in ASEAN

- Russia became part of the ASEAN Regional Forum in 1995 with the Association of Southeast Asian Nations (ASEAN) and became a full dialogue partner in 1996.

- Each ASEAN country presents its own unique investment opportunities to Russian businesses, ranging from exports of military hardware to wheat to high-tech manufacturing.

- Two-way trade between ASEAN and Russia has increased modestly from US$500 million in 2005 to US$18.2 billion in 2019.

- ASEAN’s participation in the Regional Comprehensive Economic Partnership (RCEP) free trade agreement gives Russian investors access to over 2 billion consumers, of which 600 million are in ASEAN alone.

Russia became part of the ASEAN Regional Forum in 1995 with the Association of Southeast Asian Nations (ASEAN) and became a full dialogue partner in 1996. Since then, two-way trade has increased modestly from US$500 million in 2005 to US$18.2 billion in 2019.

Despite this large number, Russian foreign direct investment (FDI) in ASEAN only amounted to US$45 million for the same year; a significantly small amount considering the bloc received US$160 billion in FDI in 2019.

Most of Russia’s investments in the region have been reliant on energy — oil, gas, and nuclear — but ASEAN is diversifying its energy import partners than being dependent on one partner.

During the ninth ASEAN Economic Ministers (AEM)-Russia Consultations in August 2020, both sides saw potential in realizing initiatives in the areas of agriculture, infrastructure, financial services, and digital technologies.In addition, both sides inked the ASEAN-Russia Comprehensive Plan of Action for the period of 2021-2025 in 2020 to cooperate in the areas of security, counter-terrorism and transnational crime, science and technology, smart cities, healthcare, and disaster mitigation.

Taking advantage of regional free trade agreements

The Regional Comprehensive Economic Partnership (RCEP) free trade agreement (FTA) was signed in 2020 and comprises China, Japan, and South Korea, Australia, and the 10 ASEAN nations.

As the world’s largest free trade agreement, the RCEP gives Russian investors access to over 2 billion consumers, of which 600 million are in ASEAN alone. Trade between Russia and ASEAN will become ever more significant as Southeast Asia looks to become a more prominent trade corridor. Russia itself is a leading nation of the Eurasian Economic Union (EAEU) free trade agreement and which has already signed its own FTA with Singapore and Vietnam.

We have covered this topic in the article: New RCEP Free Trade Agreement Rules of Origin to Boost Finishing of Products Investment into Cambodia, Laos & Myanmar

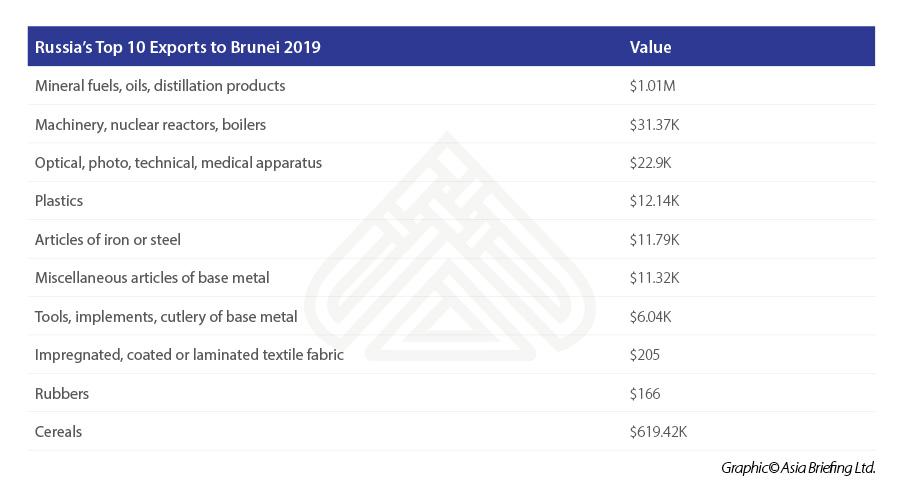

Brunei

Russian exports to Brunei reach US$1.1 million annually, given Brunei’s small economy and population size.

Although the majority of Russian exports are in energy, there are opportunities in Brunei’s agriculture sector. In 2019, Brunei’s gross agricultural output was US$322 million, an increase of US$42 million from the previous year.

Currently, the sector contributes only 0.5 percent of GDP, and the government wants to increase productivity through the use of advanced technology, in addition to exploring downstream food processing.

This makes Brunei ideally placed to become a regional food supplier with the potential focused industries being vegetables, agri-food production, broilers, and cut flowers.

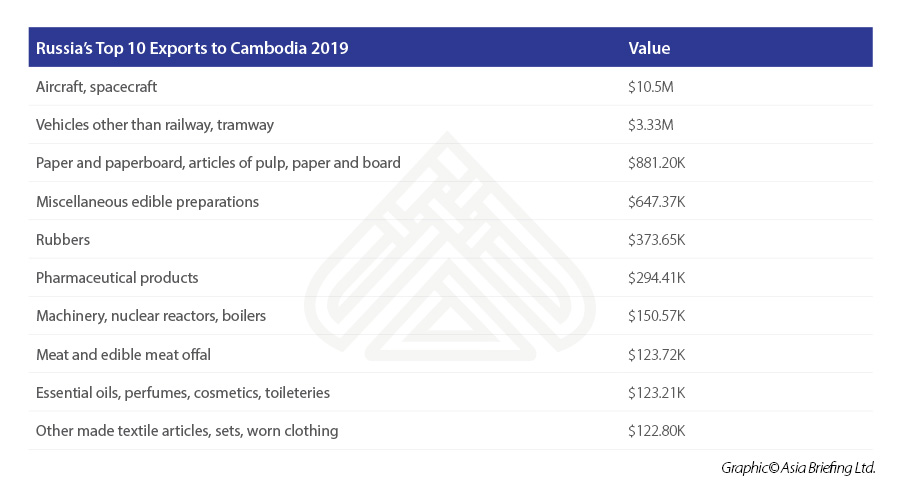

Cambodia

Cambodia’s diversification of its economy has been slow in progress, and the country is seen as an industry-specific investment destination, mainly in garments and textile manufacturing, which accounts for 16 percent of GDP and 80 percent of total exports annually.

With the enactment of the RCEP, Russian clothing brands can take advantage of the new unified rules of origin to invest in manufacturing for the finishing of garments. Bilateral trade between the two nations reached US$55 million in 2019.

The European Union (EU) partial withdrawal of Cambodia’s ‘Everything but Arms’ (EBA) status in 2020 impacted some one-fifth of the country’s exports (particularly textiles and garments), valued at over US$1 billion. The EBA status gives 49 of the world’s poorest nations duty-free access to EU markets.

Another opportunity is in the field of tourism services. Cambodia is aiming to catch a bigger share of the 30 million Russian tourists that traveled worldwide prior to the pandemic.

We have covered this topic in the article: Growing Opportunities for Russian Businesses in Cambodia

Related reading: Eurasian Economic Union Integration Unit Meets with Cambodian Ministry Of Commerce

Indonesia

Indonesia and Russia have had diplomatic relations since 1950 and total bilateral trade reached US$1.93 billion in 2020. The majority of Russian exports were energy-related although more opportunities in other sectors have emerged in other industries.

What industries show the greatest potential for Russian investors?

Military equipment

Russia has long been a major supplier of military hardware to Indonesia. Over the past 25 years, Russia has delivered weapons worth more than US$2.5 billion to the archipelagic nation, which include Sukhoi fighter jets, and infantry fighting vehicles. From 2000 to 2017, Indonesia accounted for 10 percent of Russia’s arms exports to the region.

Indonesia has ambitious plans to modernize its military with defense spending set to increase to between two and three percent of GDP. Russia could play a vital role in supplying a critical weapons system at a much lower rate than Indonesia’s traditional defense partner, the US.

The US has exerted pressure on Indonesia recently to not purchase Russian-made military hardware with the possibility of US sanctions in the balance. Indonesia had planned to procure an additional 11 Sukhoi Su-35 fighter jets through a barter agreement whereby Indonesia would exchange a US$570 million package of commodities including rubber, coffee, and palm oil.

Digital economy

Indonesia’s digital economy is expected to be valued at US$125 billion by 2025, largely powered by e-commerce, ride-hailing apps, digital media, and online travel. Furthermore, the country has a vibrant technology sector, with the highest concentration of startups in the world.

Indonesia thus presents scalable digital opportunities for Russian investors, particularly those with expertise in the field of financial technology (fintech), Internet of Things (IoT), and cloud services.

Opportunities also lie in the digitalization of Indonesia’s small and medium-sized businesses of which the majority are in the informal sector and have no formal access to financing. P2P lending platforms for instance can serve this large underbanked population (47 million underbanked and 92 million unbanked adults) or through the use of e-wallets.

Local decacorn Gojek saw a gross transactional value of US$12 billion in 2020 and has recently completed a merger with local e-commerce giant Tokopedia in an agreement valued at US$18 billion.

Agriculture

Indonesia is a major importer of cereals, which will continue due to a growing middle-class with taste preferences for cereal-based products.

Wheat is an important cereal for Indonesian consumers and the country imports over 11 million tons of wheat annually — making it one of the world’s largest importers of the crop. The country’s tropical climate makes it difficult to grow wheat, and thus there is a reliance on imports.

Russian wheat producers can help fill this gap, although there is tough competition from Australian producers who represent between 40 to 60 percent of the imported wheat market. Another major exporter of wheat to the country is Canada, which holds a 16 percent share.

Wheat is mainly used to make bread and noodles in Indonesia and the country is considered the world’s second-largest instant noodle market only after China with demand reaching over 12 billion servings yearly.

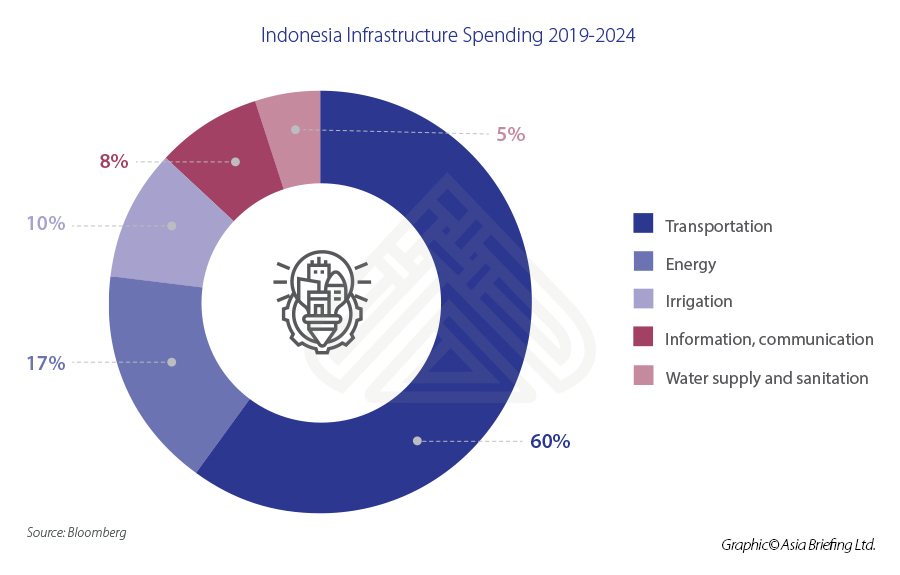

Infrastructure

Under President Joko Widodo’s second term (2019-2024), his government plans to spend some US$400 billion on infrastructure projects. This is in addition to the US$300 billion spent during his first term.

This includes developing 25 new airports, waste-to-energy facilities, as well as mass transit projects. Indonesia has invited Russia to invest in such projects, particularly utilizing Russian expertise and knowledge in building railways and seaports in Kalimantan province — a major source of Indonesia’s coal. Russia has also committed to assisting the infrastructure development of Indonesia’s new capital.

Related reading: Eurasian Economic Union Discussing Free Trade Agreements with Indonesia & Mongolia

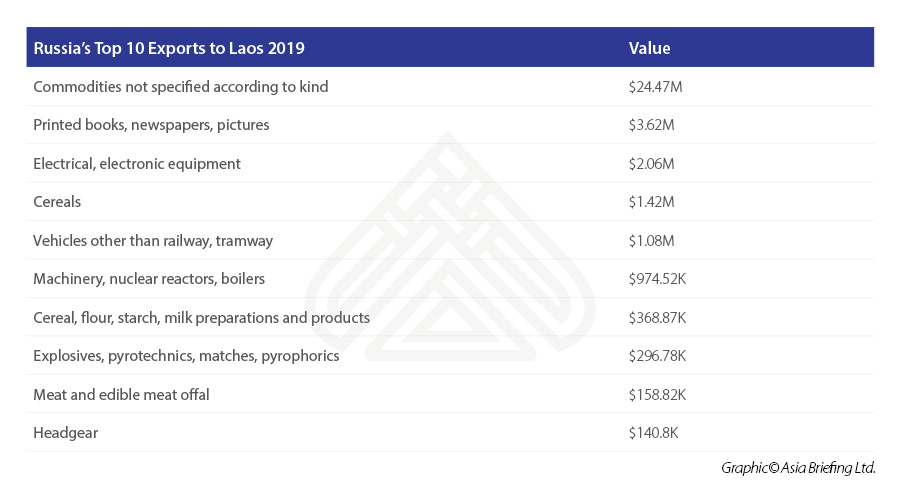

Laos

Laos is considered the least developed country in ASEAN and mining and hydropower still counts for 95 percent of FDI into the country.

According to a report by the International Hydropower Association, Russia was the seventh-largest producer of electricity in 2020 and is also the second in the world for hydropower potential.

Russian expertise in this sector can help Laos realize its own hydropower potential. The country has a theoretical hydropower potential of 26.5 GW, making Laos one of the richest sources for hydropower in ASEAN.

Laos saw a new capacity totaling 1.89 GW, which was the second-highest new added capacity in the region. The industry also accounts for 30 percent of exports with the majority of such exports going to Thailand and Vietnam.

The government aims to make hydropower the largest source of state revenue by 2025.

Malaysia

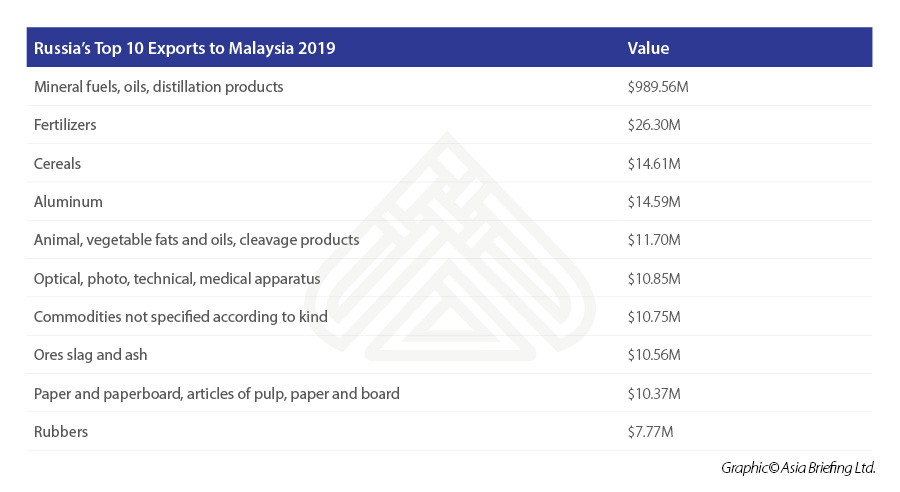

Malaysia has shifted from an agricultural and commodities-based economy to one driven by services and manufacturing. However, oil and gas, of which Russia and Malaysia are major trade partners in, still contribute to some 20 percent of GDP.

Russia and Malaysian trade reached 12.8 billion ringgit (US$3.09 billion) in 2019 and Russia is the largest investor from the Commonwealth of Independent States (CIS) in Malaysia’s manufacturing sector.

What industries show the greatest potential for Russian investors?

Manufacturing

Malaysia’s manufacturing sector has a large influence on the economy, accounting for some 40 percent of GDP. The government has provided incentives for businesses in this sector to better adopt digitalization and automation in their operations.

These include:

- Accelerated capital allowance and automation capital allowance on the first two million ringgit (US$484,000) and four million ringgit (US$968,000) on qualifying capital expenditure. This will be extended to the year 2023 for companies in the manufacturing sector; and

- The incentive is extended to companies in the services sector on the first 2 million Ringgit (US$484,000) on qualifying capital expenditure from 2020-2023.

The country is looking to move up in the supply chain value of its manufacturing sector into high-tech exports. Collaborating with Russian firms, such as for advanced digital production technologies, industrial Internet of Things, robotics, big data analysis, neuro-technology, and artificial intelligence will help Malaysia facilitate these goals.

Successful examples of Malaysian-Russian collaborations in these fields include the production of smart lighting systems, high-speed transmitters, and traffic monitoring systems.

Moreover, Malaysia is already producing over eight percent of global back-end semiconductor output. Russian investors in the electronics and electrical (E&E) sector are also eligible for a 10-year tax exemption with exports from this sector accounting for 44.7 percent of total manufactured goods exports in 2019, valued at over US$90 billion.

Healthcare

Malaysia is competing with Singapore and Thailand as a destination for medical tourism in the region.

The country’s healthcare industry is expected to be valued at US$30 billion by 2027, fueled by demand from an aging population as well as medical tourists, primarily from Asia. In 2019, one million international visitors entered the country as medical tourists, generating US$433 million in revenues.

Moreover, Malaysia’s medical device industry has room for huge growth, with exports reaching US$5 billion in 2019. More than 200 manufacturers, of which 30 are international firms who have chosen the country as their production base.

Myanmar

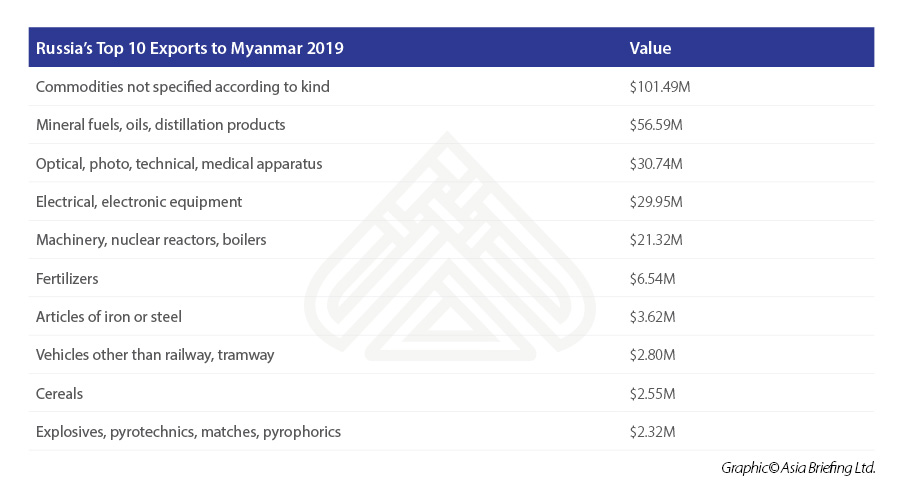

Russia and Myanmar have had close relations since the cold war era with Russia being the second-largest supplier of arms behind China (at least 16 percent of weaponry procured by Myanmar between 2014-2019 were from Russia.

Military cooperation is set to continue with Myanmar signing contracts for a Russian air defense system as well as the delivery of Sukhoi fighter jets.

Looking ahead beyond the coup

Tourism

Tourism is a developing sector the Myanmar government was eager to develop prior to the coup. In 2020, the country extended its visa-on-arrival scheme to several more countries and now includes Russia. Over four million tourists visited the country in 2019.

Stock market open to foreign investors

The Securities and Exchange Commission of Myanmar (SECM) has allowed the participation of foreign investors in the daily share trading on the Yangon Stock Exchange (YSX) as of March 2020.

The YSX only has a market capitalization of US$400 million and so permitting foreign traders will help scale up the stock market and increase liquidity.

We have covered this topic in the article: Myanmar’s Prospects for Post-Coup Foreign Trade & Investment

Philippines

Russia and the Philippines have diplomatic ties stretching from 1817, and as of 2019, total trade between the two reached US$1.22 billion. Despite the pandemic, total trade in Q1 2020 grew 4.4 percent to US$276.9 million.

Although energy and commodities sectors still dominate the majority of trade, both countries are eager in diversifying cooperation in other fields, most notably, agriculture, defense, and infrastructure.

What industries show the greatest potential for Russian investors?

Agriculture

The Philippines and Russia have explored the possibility of exporting Russian wheat to the Philippines. The country is currently the world’s third-largest wheat importer (just over 6 million tons annually), behind its ASEAN neighbor Indonesia (11 million tons).

The United Grain Company — a Russian grain trading company — is looking at opportunities for investments in the Philippines’ flour mills.

In addition to wheat exports, Russia is looking to export more poultry to the Philippines as consumption of this meat increases. The Resource Group of Companies — one of the largest poultry meat manufacturers in Russia — sent a test container containing 27 tons of chicken meat to the Philippines in 2020.

Currently, The Philippines’ largest suppliers for poultry are the US (US$98 million), Netherlands (US$87 million), and Brazil (US$47 million).

Infrastructure

President Duterte has courted Russian investors to participate in his ‘Build, Build, Build’ (BBB) infrastructure program, especially in transport and railway construction.

The government has granted income tax holidays from four to six years for participating companies in addition to availing tax and duty-free importation of capital equipment.

The BBB program comprises of over 20,000 infrastructure projects nationwide which include highways, railways, seaports, airports, and terminals, among others. The Duterte administration has allocated US$164 billion for the program (2017-2022).

Military equipment

As part of its modernization plans under the Revised Armed Forces Modernization Act as well as to avoid dependence on Western weaponry, the Philippines is seeking to increase the acquisition of Russian military hardware. The Department of Defense plans to purchase 16 Russian Mi-17 helicopters

The Act, budgeted at US$40 billion, aims to upgrade the entire Armed Forces of the Philippines. Moreover, Russia has offered to help the country produce its own arms for domestic use as well as exports with the use of Russian technology.

Singapore

Singapore and Russia have enjoyed over 50 years of diplomatic relations, and with Singapore signing an FTA with the EEU, Russia has access to Southeast Asian markets, especially since facing sanctions in 2014.

A gateway to the rest of ASEAN

There are already over 700 Russian companies based in Singapore, including Kaspersky Labs and energy giants Gazprom and Rosneft.

Strategically located in the region, Singapore has the expertise and infrastructure to enable foreign investors to access other ASEAN markets, in addition to offering a stable legal, tax, and business environment, which is highly integrated with international financial markets — over 7,000 multinationals run their Asia-Pacific businesses from the city-state.

Using Singapore as a base for a Russian company’s operations means benefiting from the country’s large number of double tax agreements (DTAs) and FTAs. No other country in ASEAN has a more extensive DTA and FTA network than Singapore, hence adding to its attractiveness to foreign investors.

A favorable tax system

Singapore has one of Asia’s most favorable tax systems with a corporate income tax rate (CIT) of 17 percent — the lowest in ASEAN. The country practices a single-tier corporate tax system, which means businesses pay CIT only on chargeable income (profits), and all dividends are exempt from further taxation.

Moreover, withholding tax applies to non-resident companies or individuals who have sourced their income from Singapore.

We have covered this topic in the article: The Singapore Advantage for Russian Investors

Thailand

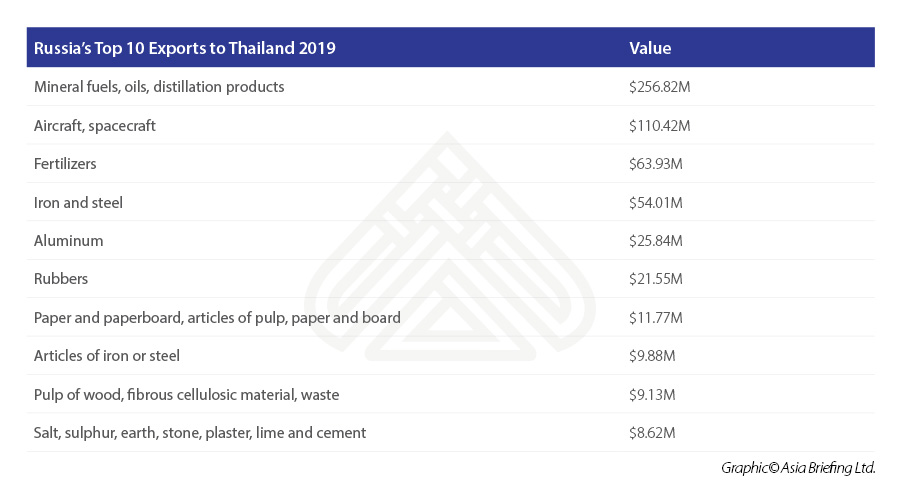

Thailand and Russia have agreed to increase bilateral trade to US$10 billion by 2023, compared to current bilateral trade valued at US$3 billion.

To achieve this trade goal, the Thai cabinet recently approved an MoU that aims to expand and enhance the economic cooperation between Russia and Thailand.

What industries show the greatest potential for Russian investors?

Manufacturing

Manufacturing is a key sector for Thailand as it contributes to over 30 percent of GDP annually. The country is looking to new technologies to upgrade this sector particularly utilizing cloud computing, the Internet of Things (IoT), and robotic automation.

A scalable opportunity for Russian investors is Thailand’s aerospace industry, and maintenance, repair, and overhaul (MRO) services. The country’s major airlines, such as Thai Airways, Bangkok Airways, and Thai Lion Air have all established MRO centers to service their aircraft and those of airlines that service Thailand and the region. Thailand’s MRO industry is expected to be valued at US$2.9 billion by 2037, boosted by the 800 aircraft and over 180 million passengers in the country.

Key MRO subsectors include engine maintenance, components, line maintenance, and airframe maintenance.

Food and agriculture

Like much of its ASEAN counterparts, wheat is a grain that is difficult to produce in Thailand due to the climate, but imports continue to increase due to changing consumption habits and rapidly increasing tourist numbers. Prior to the pandemic, Thailand imported over 3 million tons of wheat.

In addition to wheat, the best market prospects for Russian exports include meat and meat products, and dairy products. Thailand imported over US$800 million worth of dairy products in 2019 with the top three exporters being New Zealand, Australia, and the USA.

We have covered this topic in the article: Opportunities for Russian Traders As Russia, Thailand Set Trade Goals To Reach US$10 Billion By 2023

Vietnam

Russia and Vietnam marked 70 years of diplomatic relations in 2021 and despite the onset of COVID-19, total bilateral trade reached US$5.7 billion in 2020, representing a 15 percent increase from 2019.

Trade relations between the two countries are still modest although this is expected to increase as more businesses take advantage of the Vietnam-EAEU FTA. Moreover, Vietnam’s participation in the RCEP due to its association with ASEAN will give Russian companies the opportunity to promote their goods and services to over 2 billion consumers in Asia.

Oil and gas still dominate trade between Russia and Vietnam, and major Russian oil and gas groups, such as Gazprom and Rosneft, are engaging in more projects on Vietnam’s continental shelf. The Russian-Vietnamese enterprise Vietsovpetro is the eighth largest company in Vietnam and produces one-third of the country’s oil.

What industries show the greatest potential for Russian investors?

Food and agriculture

There are scalable opportunities to increase the export of Russian agricultural and food products to Vietnam, especially cereals, walnuts, pine nuts, and sunflower oil.

In addition, Vietnam was the fourth-largest buyer of Russian wheat, importing more than 1.5 million tons. Wheat is an important staple food in Vietnam as it is consumed daily in bread, noodles, and sweet biscuit products.

Garment and textile manufacturing

Vietnam is one of the world’s top exporters of textiles and garments and the industries contribute to 16 percent of GDP.

The European Union-Vietnam Free Trade Agreement (EVFTA), which took effect in August 2020, provides manufacturers with Vietnam operations new export markets. The industry has three subsectors: upstream sector, which consists of fiber production; midstream sector, involving mainly fabric production and dyeing; and the downstream sector, which consists of garment manufacturing.

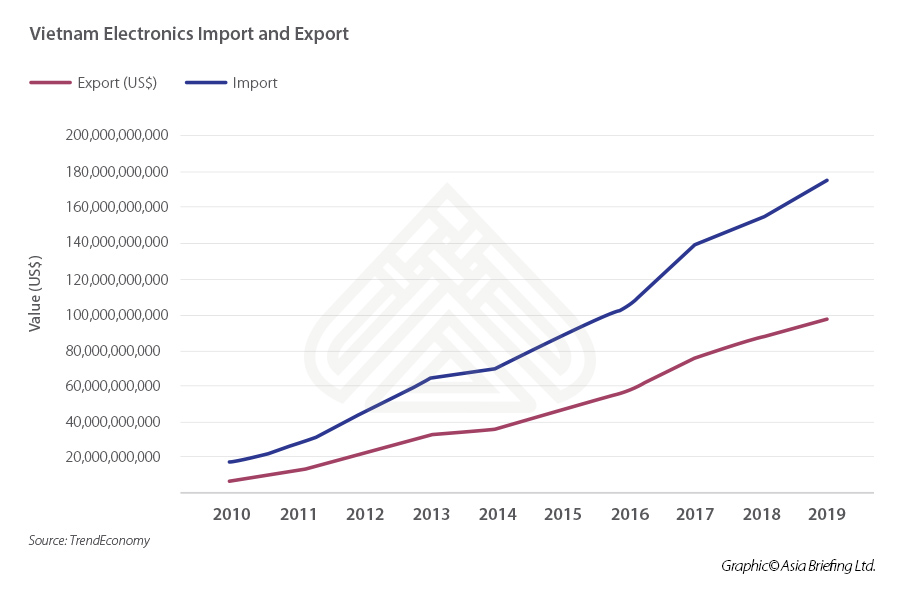

Electronics

Vietnam climbed the ranks as an electronics exporter from 47th in 2001 to 12th in 2019, boosted by the supply chain shifts from China into Southeast Asia. Mobile exports were ranked second worldwide in terms of exports, valued at over US$50 billion in 2019.

The electronics industry is already dominated by established foreign companies, accounting for over 90 percent of total exports as well as 80 percent of the domestic market. Vietnam’s main electronic exports are transmission apparatus, mobile phones, TVs, cameras (41 percent), electrical apparatus (18.2 percent), and electronic integrated circuits and micro assemblies (11.9 percent).

We have covered this topic in the article: Moscow, Hanoi Discuss Expanding the Eurasian Economic Union-Vietnam Free Trade Agreement

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Esen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia. We also have partner firms in Malaysia, Bangladesh, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.