Thailand’s E-Commerce Landscape: Trends and Opportunities

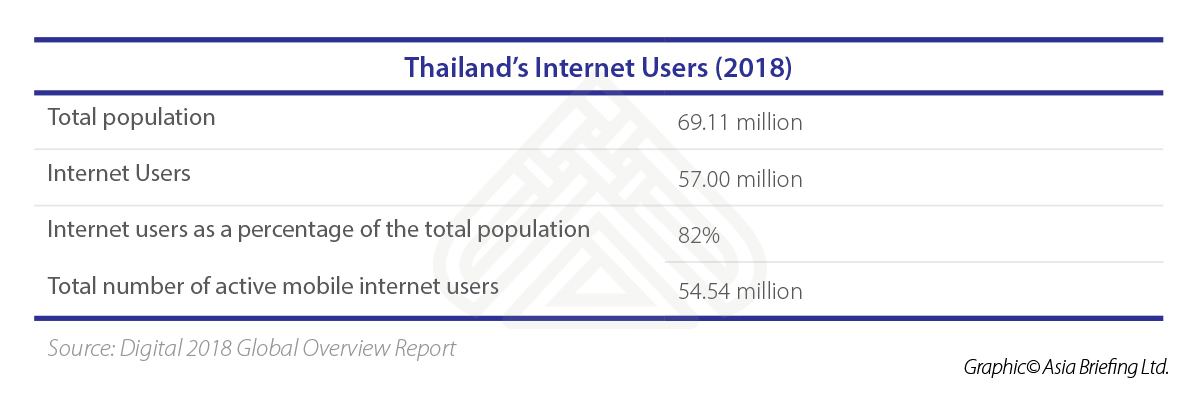

The second largest economy of Southeast Asia, Thailand has one of the region’s highest number of internet users. There are approximately 57 million internet users in the country that are well-versed in the use of digital technologies, mobile, and e-commerce.

The growing internet user base makes Thailand an ideal growth environment for e-commerce businesses. At present, the Thai e-commerce market is valued at US$3.5 billion and is expected to generate revenue growth rate of 13.2 percent annually, reaching US$5.8 billion in 2022.

![]() RELATED: Corporate Establishment and Structuring Services from Dezan Shira & Associates

RELATED: Corporate Establishment and Structuring Services from Dezan Shira & Associates

In this article, we discuss some of the latest trends and opportunities for online businesses in the country.

Thailand – the biggest social commerce market

According to market reports, over 50 percent of Thai online shoppers purchase products through social networks. The user base comprises mostly the young: 76 percent of 15 to 19-year-olds, 52 percent of 20 to 29-year-olds, and 34 percent of 30 to 39-year-olds.

To maximize customer reach in the over-crowded online market, many e-commerce merchants set up Facebook and Instagram pages where they post images and details of their products. This enables online browsers to inquire and discuss the product details directly with the company or the merchant, and further facilitate the deal.

Currently, Facebook and Instagram have upwards of 10,000 operating online stores in Thailand. Because of their dominance and reach, these platforms must be considered as serious competitors to companies looking to disrupt the e-commerce marketplace in Thailand.

Payment preferences

Like most emerging e-commerce markets in Southeast Asia, cash reigns as the most popular choice of payment in Thailand. Approximately 70 percent of the online shoppers prefer cash on delivery (COD) in the country.

However, alternative payment methods such as e-wallets, mobile banking, internet banking, and credit and debit cards are slowly gaining prominence under the Thai government’s National e-Payment master plan. Under this initiative, the Thai Ministry of Finance and commercial banks have jointly enabled the installation of a total 550 thousand electronic data capture (EDC) terminals nationwide to support credit/debit card payment.

In 2017, the government launched PromptPay service that allows registered customers to transfer funds using only mobile phone numbers or citizen ID. The scheme has already received 14 million registrations by the start of 2018. Several other private enterprises and large banks have renewed their mobile application to enable QR code payment, whilst non-banks such as TrueMoney, m-Pay, AirPay promote their services to draw in more e-Wallet users.

Logistics

The continued expansion of e-commerce business has increased the demand for logistics space and brought about significant changes in the supply chain and logistics operations in Thailand.

Several courier companies have launched their cost-effective and high-quality logistics services and brought domestic end-to-end delivery to the market. Many companies have established central warehouses, along with smaller drop-off and pickup point across the country, to sustain the rise in demand. For small and medium enterprises, this means greater convenience and a quicker process to deliver to their consumers, at much lesser cost.

Aden, Central Group, DHL Express Thailand, Kerry Express, Lazada, Pomelo, and Shopee, are some of the major e-commerce and logistics companies in the country.

Opportunities for businesses

The Digital Thailand 4.0 program, started in 2016, has brought about a wave of opportunities for e-commerce businesses in the country. The initiative has increased internet adoption, and encouraged businesses – especially small and medium enterprises in remote areas, to use e-payments and e-marketplaces to sell local products and services.

Currently, 12.1 million Thais shop online and spend an average of US$ 243 per year on e-commerce. The annual online expenditure per person is expected to grow to US$ 382 by 2021, according to research reports.

The variety of products sold on e-commerce platform is, too, expected to grow significantly. Some of the key verticals of the Thai e-commerce industry are discussed below.

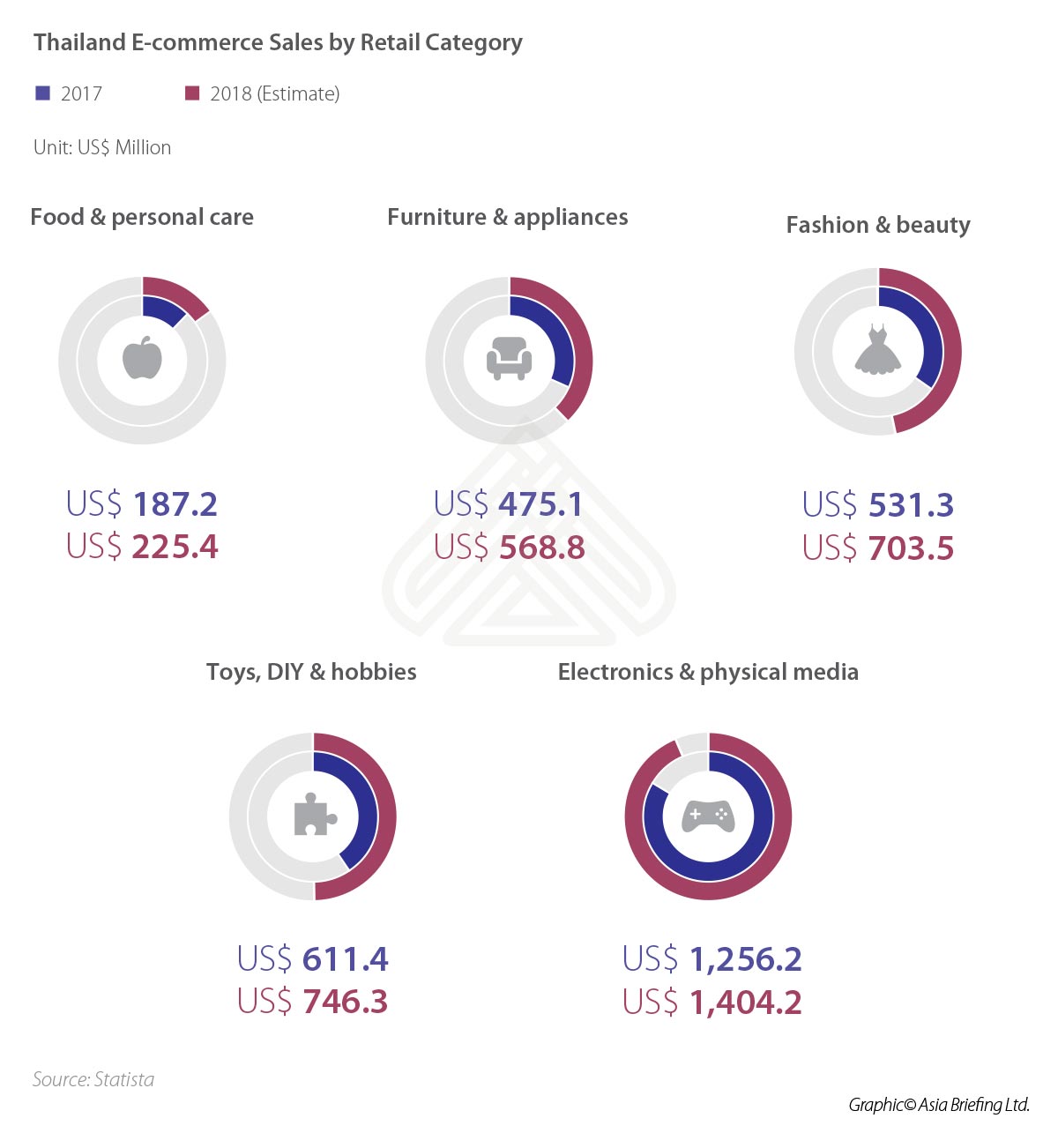

- Electronics and media

Currently, electronics and media is the leading e-commerce vertical in terms of total sales.

The segment is worth US$ 1.2 billion and includes the online sales of physical media, such as DVDs, books, and games; consumer electronics, such as television and stereo systems; and communication devices including computers, smartphones, and tablets.

Some of the major players in this vertical include JIB, Advice, Power Buy, IT City, Banana Store, Munkong Gadget and HP.

RELATED: Thailand’s Investment Outlook for 2018

RELATED: Thailand’s Investment Outlook for 2018

- Toys, DIY and hobbies

Toys, DIY and Hobbies is the second largest segment in Thailand’s e-commerce industry. Recording a robust growth in 2017, the sector is estimated to grow rapidly in the next five years with the ongoing proliferation of online and mobile games in the country. The prominent global players in this segment are Sony Thai, Wangdek Toysland Co (Mattel) and BANDAI NAMCO Group.

- Fashion and beauty

Fashion and beauty is the fastest growing and the most competitive online market segment in Thailand. In 2017, the sector accounted for US$525 million or 17.8 percent of the total e-commerce revenue. Reebonz, WearYouWant, Topshop, Zalora, Zilingo, Season, Adidas, Uniqlo, Konvy.com, and Kiehl’s are some of the leading players in this vertical.

- Furniture and appliances

Revenue in furniture and appliances amounted to 475 million in 2017 and is expected to show an annual growth rate of 13.5 percent in 2022. Index Living Mall, Home Pro, and SB Design Square are the popular online furniture and appliances stores in Thailand.

- Food and personal care

Food and personal care is the smallest yet an important e-commerce market segment, comprising sales of food and beverages, cosmetics, pharmaceutical and medical products. The segment is estimated to generate US$225.5 million revenue in 2018, and grow 16 percent in the next five years.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City and Jakarta. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Thailand’s E-Commerce Tax

- Next Article Perspectivas para la inversión extranjera directa en Malasia para 2017: tendencias y oportunidades