Indirect Taxation Across ASEAN

VAT and GST rates within ASEAN vary widely between member states – from 12 percent in the Philippines to countries which do not currently levy these taxes at all, such as Laos and Myanmar. For those considering investment, GST, VAT, and other taxation tied to the purchase of specific goods should be watched closely.

Singapore Removes Spot Pricing Requirements for Precious Metal GST Exemptions

Investors in Investment Precious Metals (IPMs) will no longer be required to base pricing on commodity spot prices to claim exemption from GST. Understand what has changed and how the new policy is likely to impact investment.

Malaysia Announces 70% Tax Exemption for Shipping Industry

Malaysia is one of the most prolific traders within the ASEAN bloc. Helping to ensure the longevity of this position, the country has introduced a 70 percent tax incentive for those in the shipping industry. Understand the particulars of these incentives and learn how you may benefit.

ASEAN Regulatory Brief: Investment Treaties in Singapore, Digital Tax in Malaysia, and Removal of a US Ban on Indonesian Flights

In this week’s ASEAN Market Watch we analyze Singaporean Investment agreements with several African states, highlight Malaysian digital taxes, and discuss removal of a US flight ban on Indonesian aircraft.

The Guide to Corporate Establishment in Labuan, Malaysia

Malaysia is one of ASEAN’s most mature economies and presents a variety of investment opportunities for those seeking to enter Southeast Asia. Learn how to set up and operate in Labuan, Malaysia, with expert insight on incorporation, registration, and other aspects of the Labuan Companies Act of 1990.

An Introduction to Malaysian GST

Malaysia has introduced Goods and Service Taxation (GST) as of April 2016. Learn how this tax has been implemented and understand its projected impact on business throughout the country.

ASEAN Regulatory Brief: Bankruptcy in Singapore, Lackluster Economic Plans in Myanmar, and Licenses in Indonesia.

In this week’s ASEAN Regulatory Brief we assess bankruptcy legislation in Singapore, highlight the shortcomings of economic plans in Myanmar, and discuss environmental standards and their impact on licensing in Indonesia.

Cascade Asia Upbeat on Renewed Opportunities in Indonesian Manufacturing

Read and download expert analysis from Cascade Asia Advisors’ latest publication, Manufacturing in Indonesia: new options, opportunities and challenges.

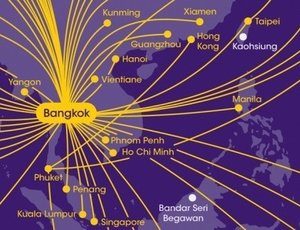

The Benefits of Regional Management in Thailand

Thailand is seeking to position itself as a regional management center within ASEAN. Read more to learn about incentives offered by the Kingdom as well requirements needed to tap into these opportunities.

The Guide to Corporate Establishment in Myanmar

Myanmar is one of ASEAN ‘s most exciting frontier markets. Learn how to tap into opportunities with our step-by-step guides on the establishment of foreign branch offices and private limited companies.