Malaysia Airport Tax Hikes Scheduled for 2017

Malaysia is set to implement a series of tax increases for both domestic and international bound flights starting in 2017. With rates confirmed, criticism and outcry from the nation’s aviation industry has been growing as many worry about the ramifications for regional aviation.

Philippine Tax Amnesty Proposed in a Bid to Increase Revenue Collection

A Philippine tax amnesty has been proposed in an effort to increase state collections and mitigate reduced revenues projected in the wake of planned corporate tax reductions. Understand the terms of the amnesty and how you may qualify for relief.

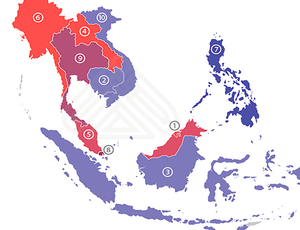

The State of ASEAN M&As in 2016

In its most recent investment report for 2016, ASEAN has focused heavily on the intertwined issues of mergers and acquisitions (M&As). Learn which parties are at the forefront of these acquisitions and where opportunities lie in the near to medium term.

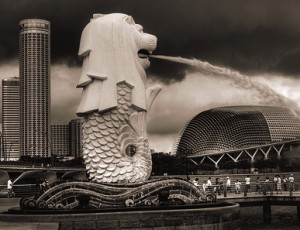

ASEAN Market Watch: Fintech in Singapore, Declining Philippine Exports, and Google’s Tax Troubles in Indonesia

In this week’s ASEAN Market Watch we discuss fintech in Singapore, analyze declining Philippine exports, and highlight Google’s tax troubles in Indonesia

Myanmar Opens Three Overland Crossings to e-Visas

Myanmar has extended e-visas for tourists and business professionals to three land crossings: Tachileik, Myawaddy, and Kawthaung. Learn what you will need to apply.

Industry Spotlight: Identifying Opportunities in ASEAN Real Estate

ASEAN’s real estate market has become one of the region’s most promising investment opportunities as increased growth and supporting demographics facilitate demand. Learn more about three of the region’s most promising opportunities for investment.

CorpPass Set to Replace SingPass for Businesses in Singapore

CorpPass is to replace SingPass for business interactions with government e-services. Understand the rollout, and learn how to apply for CorpPass as we analyze the G2B interface.

ASEAN Regulatory Brief: Tax Evasion in Singapore, Business Registration in the Philippines, and Indonesian Banking Rules

In this week’s ASEAN Regulatory Brief we highlight Singapore’s recent tax evasion agreement with Australia, discuss streamlined business registration in the Philippines and Indonesian banking rules

Indirect Taxation Across ASEAN

VAT and GST rates within ASEAN vary widely between member states – from 12 percent in the Philippines to countries which do not currently levy these taxes at all, such as Laos and Myanmar. For those considering investment, GST, VAT, and other taxation tied to the purchase of specific goods should be watched closely.

The Philippines Resumes Tax Audits Following Internal Review

The Philippines has announced the resumption of field audits from the Philippine Bureau of Internal revenue. Understand how the functions of the BIR have changed and what field audits will mean for your Investments.