In Depth: The Singapore – Thai DTA

By: Dezan Shira & Associates

Editor: Maxfield Brown

Singapore, long known for its exemplary investment climate and lucrative trading arrangements, continues to improve upon its competitiveness with the implementation of an updated Double Taxation Agreement (DTA) with Thailand. Minimizing investors exposure to taxation in multiple jurisdictions, this DTA, along with Singapore’s many others, is a critical components in attracting foreign investment and maximizing profitability for those incorporated within the city’s limits.

At a time where regional integration and rapidly expanding FTAs are defining the flow investments within The Association of South East Asian Nations (ASEAN), taxation agreements with fellow ASEAN members such as Thailand are likely to compound potential gains. Unlike many ASEAN nations that attract investment based on low labor costs, large consumer bases, or deposits of natural resources; the key to unlocking Singapore’s’ potential lies in a thorough understanding of its tax code and expansive trading arrangements.

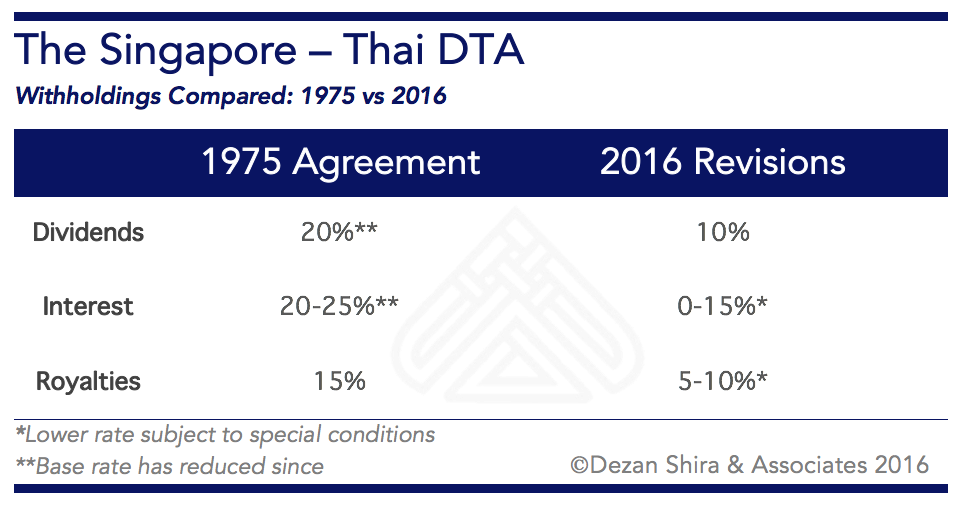

With this in mind, the following article outlines some of the most important changes found within the Singapore’s DTA with Thailand. Providing a significant update to the arrangement originally implemented in 1975 original, the 2016 version revises guidelines on dividends, interest payments, and royalties. For further reference, the full text of Singapore’s agreement with Thailand and other ASEAN member states can be accessed below:

- Thailand DTA – Full Text [Entry into force: 15 February 2016 Effective: 1 January 2017]

- Access to all DTAs involving ASEAN members

Should any questions arise from the following information or the agreements at large, those considering investments or currently operating within Singapore are strongly encouraged to contact relevant government officials or professional services.

RELATED: International Tax Planning Services from Dezan Shira & Associates

RELATED: International Tax Planning Services from Dezan Shira & Associates

Withholdings Taxation

In addition to corporate taxes levied by the Thai government, current Thai regulations, in conjunction with the Singapore-Thai DTA, allow for limited taxation of corporate remittances. The taxation of these remittances is broken down into three categories: dividends – the remittance of profits to shareholders, interest – payments relating to debts, and royalties – payments to third parties for the use of patents or intellectual property.

Note: The following information pertains to the rates agreed upon under the DTA regarding companies invested in Thailand and seeking to remit profits to Singapore.

Dividends

Dividends are defined by Article 10(3) of the Singapore-Thailand DTA as income from:

- shares

- “jouissance” shares / rights

- mining shares

- founders’ shares or other rights not being debt-claims

- participation in profits

- income from other corporate rights “subjected to the same taxation treatment as income from shares by the laws of the State of which the company making the distribution is a resident.”

Rates

Dividend withholdings will largely remain unchanged with the passage of the Singapore – Thailand DTA. While the previous agreement, originally signed in 1976, set dividend withholdings at 20%, Thailand has since reduced its tax on withholding to 10% – the same as the rate within the DTA and thus affording those incorporated in Singapore little advantage with regard dividend remittances.

Royalties

Royalties within the DTA have been substantially reduced under Article 12 of Singapore’s DTA with Thailand. There are some instances where royalties can qualify for up to a 10 percent discount under the DTA when compared to states with out of date or non existent taxation agreements.

Royalties under the Singapore-Thai DTA are subject to a three tired system of withholdings taxation – ranging from 5 to 10 percent depending on the nature of the royalty payment in question. To qualify for lower rates the following should be noted:

5 percent rate

Art.12(2)(a) limits the application of a 5 percent withholding to royalties paid for the right to use copyrights of:

- literary

- Artistic

- or Scientific works

8 percent rate

Art. 12(2)(b) limits the withholding rate of 8 percent to royalty payments regarding:

- patents

- trade marks

- designs

- models

- plans

- secret formulas or processes

- or for the use of, or the rights to use, industrial, commercial, or scientific equipment

10 percent rate

Art. 12(2)(c) indicates that in cases that royalties do not meet the qualifications for 5 or 8 percent withholding they are then to be subject to a 10 percent rate of withholding.

RELATED: Annual Audit and Compliance in ASEAN

RELATED: Annual Audit and Compliance in ASEAN

Interest

Similar to dividends, Singapore’s arrangement with Thailand concerning interest, while marking a substantial improvement over its 1976 predecessor, does little to reduce applied withholding rates. At present, companies will be subject to a 10 to 15 percent withholding regardless of their coverage under given DTAs. Nonetheless, the following requirements should be noted for those seeking to qualify for lower withholding rates:

10 percent rate

Art. 11(2)(a) and (b) outline two situations where interest withholdings may be reduced:

- If the owner of the interest is a financial or insurance institutions

- If the owner of the interest is a Singapore resident – see article 4 for more information – and the payment is made with respect to indebtedness arising from the sale on credit of equipment or services.

15 percent rate

Art. 11(2)(c) indicates that a 15 percent rate of withholding shall be applied in all situations that do not meet the requirements outlined in Art. 11(2)(a) or (b).

Exemptions

While a 10 to 15 percent rate is applied for the vast majority of interest related remittances, the Singapore-Thai DTA does provide exemptions for payments to certain governmental institutions. Art. 11(4)(a) indicates interest remittances to the following bodies in Singapore are exempt from interest withholdings levied by the Thai government:

- the Monetary Authority of Singapore

- the Government of Singapore Investment Corporation Pte Ltd

- a statutory body

- any institution wholly or mainly owned by the Government of Singapore as may be agreed from time to time between the competent authorities of the Contracting States.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Annual Audit and Compliance in ASEAN

For the first issue of our ASEAN Briefing Magazine, we look at the different audit and compliance regulations of five of the main economies in ASEAN. We firstly focus on the accounting standards, filing processes, and requirements for Indonesia, Malaysia, Thailand and the Philippines. We then provide similar information on Singapore, and offer a closer examination of the city-state’s generous audit exemptions for small-and-medium sized enterprises.

The Trans-Pacific Partnership and its Impact on Asian Markets

The Trans-Pacific Partnership and its Impact on Asian Markets

The United States backed Trans-Pacific Partnership Agreement (TPP) includes six Asian economies – Australia, Brunei, Japan, Malaysia, Singapore and Vietnam, while Indonesia has expressed a keen willingness to join. However, the agreement’s potential impact will affect many others, not least of all China. In this issue of Asia Briefing magazine, we examine where the TPP agreement stands right now, look at the potential impact of the participating nations, as well as examine how it will affect Asian economies that have not been included.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.