Bilateral relations between Germany and Singapore began to strengthen after the cold war with bilateral trade reaching over US$17 billion in 2021, an increase from US$11 billion in 2020.

Germany enjoys a trade surplus with Singapore importing more than US$10.3 billion of products in 2021, comprising mostly of; electrical machinery and equipment (US$2.4 billion); machinery, electrical appliances, nuclear reactors (US$2.2 billion); optical, medical, surgical, and photographic equipment (US$US$978 million); vehicles and their parts and accessories (US$853 million); and pharmaceutical products (US$465 million).

Singapore exported some US$7 billion worth of products in the same year which was dominated by electrical and electronic equipment (US$3.3 billion), machinery and mechanical appliances (US$1.6 billion), and medical equipment (US$940 million). Singapore’s medical devices industry is expected to be worth US$1.3 billion by end of 2022. Some 60 percent of the world’s microarrays and one-third of the world’s mass spectrometers are manufactured in Singapore.

German-Singapore business ties continue to grow

The European Union-Singapore Free Trade Agreement (EUSFTA), which came into force in 2019, has been an important economic bridge to enhance German and Singapore trade and business ties. Singapore is the EU’s largest trading partner in ASEAN with annual bilateral trade in goods and services exceeding US$103 billion. Further, bilateral foreign direct investment between the EU and Singapore exceeds US$368 billion.

There are more than 10,000 European companies active in Singapore and including over 2,000 German companies such as Bauer, Lufthansa, Dorma, and Schaeffler. These companies, in addition to many German small and medium enterprises (SMEs), have used the city-state as their regional base, allowing for easy expansion into other Southeast Asian markets. German SMEs, also known as Mittelstand, serve as the backbone of the country’s economy and are often world leaders in their respective industries.

Further, despite the COVID-19 pandemic, Singapore continues to be an attractive destination for German investments. German logistics company DB Schenker opened its new warehouse in Singapore in August 2020, investing approximately S$150 million (US$109 million) in the process. Located in the Airport Logistics Park of Singapore at Changi International Airport, the warehouse operates the latest sustainable warehouse management system.

German testing, inspection, and certification company TUV SUD opened its new S$100 million (US$72.8 million) facility at the International Business Park in Jurong Island, in 2021. The facility houses more than 60 laboratories and will be a launchpad for collaboration in new areas of economic growth, such as the digital economy and sustainability.

Also, in mid-2019, German chemical giant Evonik established its second methionine plant in Singapore. The plant enables Evonik to double its production capacity of methionine from 150,000 tons to 300,000 tons. Methionine is a key additive in animal feed. Built at the cost of US$768 million (US$559 million), the plant is a twin of the first one built in 2014 in the city-state.

These examples highlight the important role Singapore plays for German companies seeking to expand their foothold in the Asia-Pacific.

Benefitting from Singapore’s free trade agreements

An important aspect of why German companies have continued to invest in Singapore is because of the city-state’s vast free trade agreement network, in particular the European Union-Singapore Free Trade Agreement (EUSFTA).

Despite regional players maintaining strong FTA networks, they are not as extensive as Singapore’s.

The country’s 14 bilateral and 13 regional FTAs include some of the largest combined trade agreements in the ASEAN-China, ASEAN-India, and ASEAN-Hong Kong trade blocs — providing Singapore-based businesses with access to preferential markets, free or reduced import tariffs, as well as enhanced intellectual property regulations.

There are two types of FTAs: bilateral (agreements between Singapore and a single trading partner) and regional (signed between Singapore and a group of trading partners).

Bilateral FTAs

- China-Singapore FTA (CSFTA);

- India-Singapore Comprehensive Economic Cooperation Agreement (CECA);

- Japan-Singapore Economic Partnership Agreement (JSEPA);

- Republic of Korea-Singapore FTA (KSFTA);

- New Zealand-Singapore Comprehensive Economic Partnership Agreement (ANZSCEP);

- Panama-Singapore FTA (PSFTA);

- Peru-Singapore FTA (PeSFTA);

- Singapore-Australia FTA (SAFTA);

- Singapore-Costa Rica FTA (SCRFTA);

- Singapore-Jordan FTA (SJFTA);

- Sri Lanka-Singapore FTA (SLSFTA);

- Turkey-Singapore FTA (TRSFTA);

- United States-Singapore FTA (USSFTA); and

- UK-Singapore FTA (UKSFTA).

Regional FTAs

- ASEAN-Australia-New Zealand Free Trade Area (AANZFTA);

- ASEAN-China Free Trade Area (ACFTA);

- ASEAN-Hong Kong, China Free Trade Area (AHKFTA);

- ASEAN-India Free Trade Area (AIFTA);

- ASEAN-Japan Comprehensive Economic Partnership (AJCEP);

- ASEAN-Republic of Korea Free Trade Area (AKFTA);

- ASEAN Free Trade Area (AFTA);

- Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP);

- EFTA-Singapore FTA (ESFTA);

- Singapore-Eurasian Economic union (EAEUSFTA);

- Regional Comprehensive Economic Partnership (RCEP);

- GCC-Singapore FTA (GSFTA); and

- Trans-Pacific Strategic Economic Partnership (TPSEP).

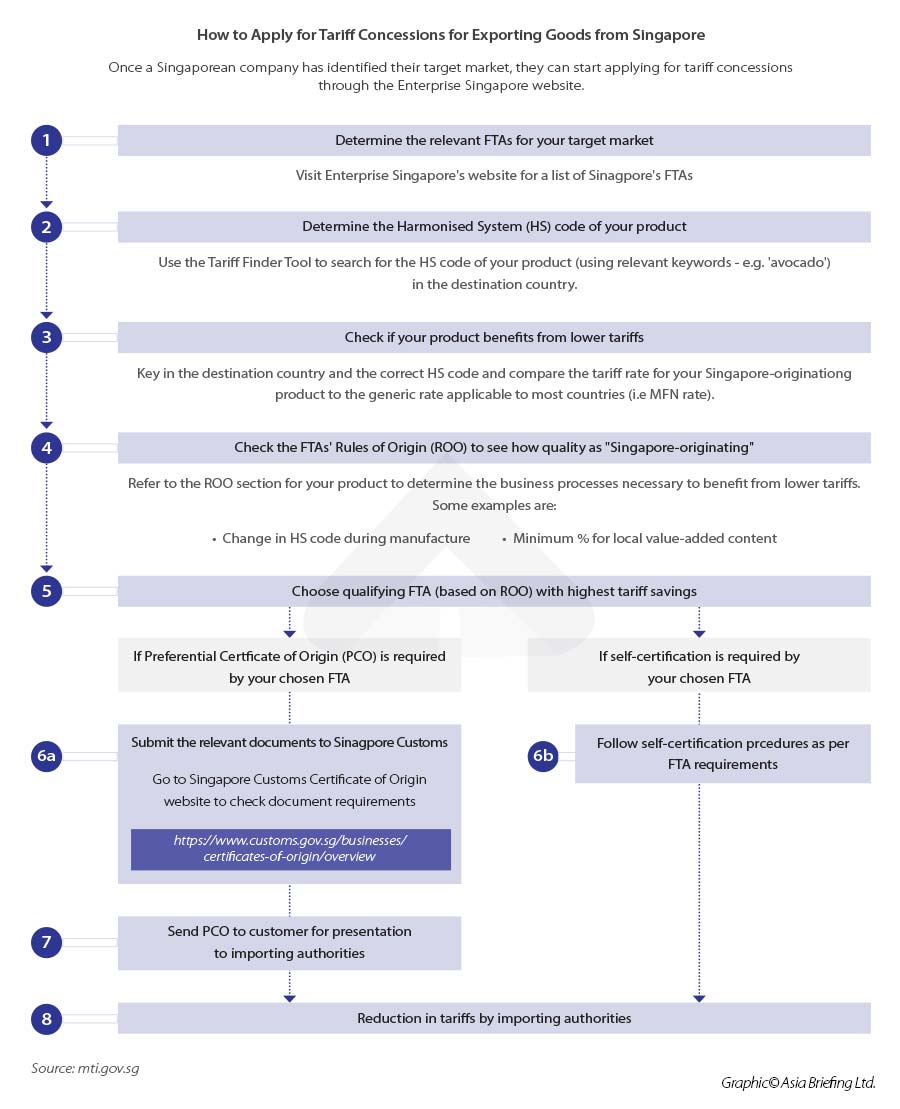

How to apply for tariff concessions for exporting goods from Singapore

Once a Singaporean company has identified its target market, it can start using tariff concessions through the Enterprise Singapore website.

Taking advantage of Singapore’s double tax agreement network

Singapore has one of the world’s most extensive DTA networks, attracting international businesses from a multitude of conventional and nuanced industries. The country has signed over 90 DTAs, which comprise three types: comprehensive, limited, and exchange of information arrangements (EOIAs).

Comprehensive DTAs provide relief from double tax for all income types between the two signatories. Limited DTAs, however, only provide relief from income generated from air transport and shipping, and EOIAs are provisions for the exchange of tax information.

The tax reliefs under each DTA treaty differ for each country. They normally cover several income types:

- Tax on royalties;

- Tax on dividends;

- Tax on capital gains;

- Tax on interests;

- Shipping and air transport;

- Directors’ fees;

- Independent and dependent personal services;

- Researchers;

- Students; and

- Income from immovable property.

How to avail the benefits of a Singapore DTA

To benefit from Singapore’s extensive network of DTA’s, the individual or company must be a tax resident of Singapore or the other country.

A Singapore resident is defined as:

- A company or body of persons whose control and management of the business is exercised in Singapore; or

- An individual who resides in Singapore and who is physically present or who exercises employment in Singapore for 183 days or more in a calendar year.

Meet our Senior Manager of International Business Advisory, David Stepat, and our Head of European Business Development, Riccardo Benussi, at the 17th Asia Pacific Conference of German Business (APK) which takes place in Singapore from 13–14 November 2022.

Organized by the German Chamber of Commerce in Singapore and the OAV (German Asia Pacific Business Association), German Chancellor Olaf Scholz and Vice-Chancellor Robert Habeck are honoring the conference with their presence and active participation.

The conference's objective is to provide a platform to deepen the dialogue on current economic developments in Europe and the Asia-Pacific region as well as to build and strengthen personal and economic ties.