In line with Singapore’s business-friendly environment, the country’s import and export procedures are relatively efficient and simple, and the necessary permits and licenses are issued relatively quickly.

Singapore is one of Asia’s largest trading hubs and has successfully established important alliances that ply the main shipping route from Asia to Europe in addition to establishing strong feeder networks with smaller regional ports. The Port of Singapore handles over 37.2 million twenty-foot equivalent units (TEUs) of containers and 626.2 million tons of cargo annually, making it one of the world’s busiest.

Moreover, prior to the pandemic, Singapore’s Changi International Airport was the seventh busiest airport for international traffic, handling over seven thousand flights weekly, and over two million tons of cargo.

What to do before trading

In order to begin trading in Singapore, the entity must first be registered with the Accounting and Corporate Regulatory Authority (ACRA) — the national regulator of businesses in the country.

Once a company is registered, it will receive a Unique Entity Number (UEN), which is a standard number issued for every Singapore entity. All government agencies will identify a company by their UEN.

Importing goods into Singapore

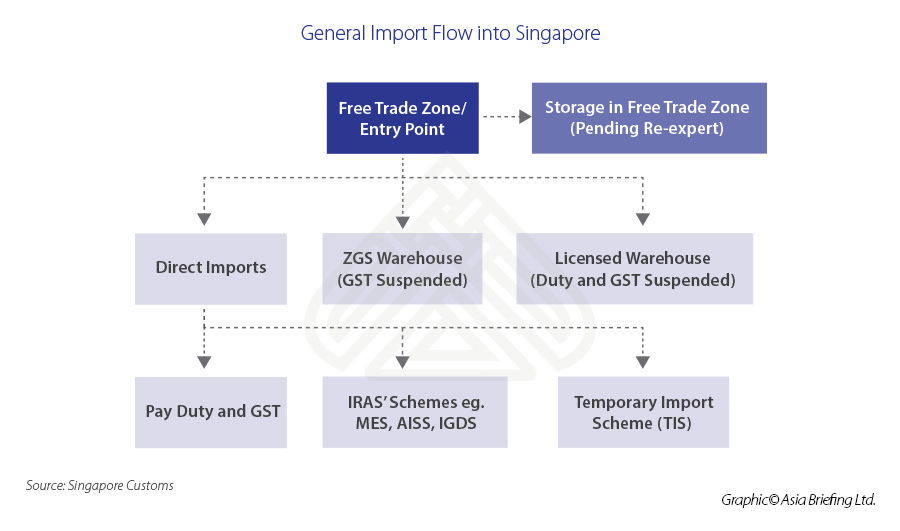

As an importer, the company will need to determine if duty or Goods and Sales Tax (GST) payments are required on the products they are importing.

Importers should note that:

- Duty and/or GST are suspended when goods remain inside free trade zones (FTZ);

- Duty and/or GST are payable if goods are released directly for local circulation;

- When goods are moved from an FTZ into customs licensed premises (such as zero-GST warehouses or licensed warehouses), duty and/or GST will be suspended as long as the goods are stored in the licensed premises; and

- Duty and/or GST is not payable for goods granted GST relief or those imported under the Temporary Import Scheme under Singapore Customs. This also includes Inland Revenue Authority of Singapore (IRAS) schemes:

- The Major Exporter Scheme (MES);

- Approved Import GST Suspension Scheme (AISS); and

- The Import GST Deferment Scheme (IGDS).

Registering or declaring a declaring agent

To receive an import or export permit, the company must first activate a Customs Account.

If the company is applying for the permit under their own name, then the company will need to register as a declaring agent and apply for an inter-bank GIRO with Singapore Customs for any duty/GST payments.

If the company is appointing a declaring agent to apply for the permit, then they will need to coordinate with the declaring agent to assist in the permit application.

The Singapore Customs defines a declaring agent as an entity that is making an application for a permit on behalf of the trading company.

Checking if the goods are controlled

All importers should check if the intended goods they want to import are controlled goods or are goods subject to restrictions in Singapore.

When a good is restricted, the relevant competent authority will be listed next to the good’s HS code on the Singapore Customs database.

Furnish security

Security is required to be furnished for undertakings involving dutiable goods, temporary import of goods for approved purposes, and for the operation of licensed premises, including warehouses and excise factories. Bank or finance company guarantees and insurance bonds are acceptable forms of security.

Obtaining the permit

Once the aforementioned steps have been completed, the applicant can obtain a customs import permit.

All permit applications will cost approximately S$2.88 (US$2.17) and must be submitted via TradeNet.

Documents for cargo clearance

For any containerized cargo entering Singapore by air or land, the importer is required to produce their customs permits and other supporting documents, such as invoices or airway bills to the customs officers for verification.

Any containerized cargo entering Singapore by sea will not require printed copies of supporting documents to be shown to checkpoint officers.

Exporting goods from Singapore

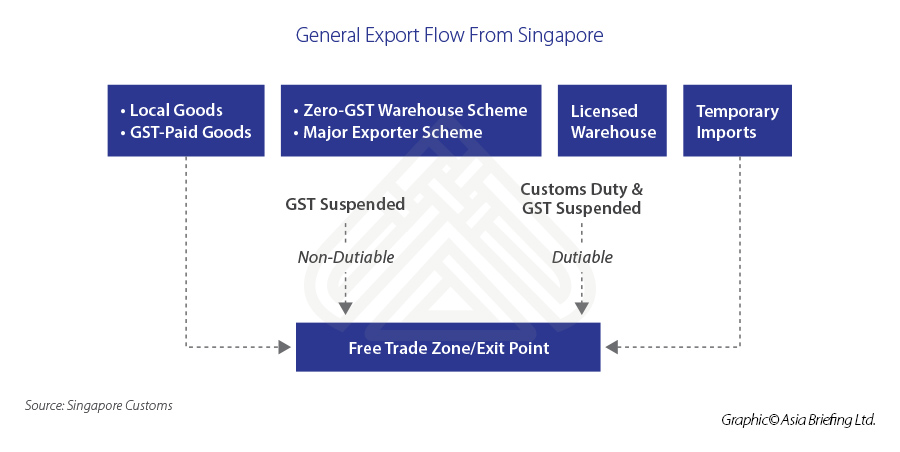

Goods must be declared to Singapore Customs if they are intended for export, and in such cases, there is no GST and duty levied on the goods.

An export permit from Singapore Customs is required for:

- Temporary export of goods that are intended to be re-imported;

- The re-export of goods under the Temporary Import Scheme;

- The export of locally manufactured goods or local GST-paid goods;

- Export of non-dutiable goods from a zero-GST warehouse, and goods under the Major Exporter Scheme;

- Export of dutiable goods from a licensed warehouse; or

- Export of goods from the FTZ.

The process for obtaining an export permit is the same as with an import permit. The applicant must declare if they are the declaring agent or will appoint a declaring agent on their behalf.

Editor's note: The article was first published on September 9, 2016, and has been republished on June 10, 2021, as per the latest developments.