It is important for companies operating and hiring employees in Singapore to understand the key elements of the country’s payroll process and stay updated on the latest regulatory changes when computing salary.

Singapore does not have a minimum wage for most sectors. Wages are determined on market demand and the supply of labor. Employers are to expected pay employees based on their competencies, skills, and experience. Further, while hiring foreign employees, the employer must consider the minimum salary requirements relevant to obtain various employment passes.

Salary components

The Employment Act of Singapore defines ‘salary’ as all remuneration including allowances, base salary, bonuses, commissions and incentives, payable to an employee for work done under the contract of service.

Salary does not include:

- The value of accommodation, utilities or other amenities;

- Pension or provident fund contribution paid by the employer;

- Travelling allowance;

- Payments for expenses incurred during work;

- Gratuity payable on discharge or retirement; and

- Retrenchment benefits.

Working hours

For employees covered under the Employment Act Part IV, contractual working hours cannot exceed 8 hours per day or 44 hours per week.

This excludes break time and overtime. If the employee works more than 8 hours per day or 44 hours per week, then they must be compensated with overtime pay, which is 1.5 times the hourly basic rate of pay.

Employees cannot work more than 12 hours per day, inclusive of overtime, unless under specific circumstances such as national security.

Employees covered under the EA are entitled to one rest day per week, without pay. If the employee works on their rest day, they are entitled for more pay. This is as follows.

- If the employee works on their rest day, at the employer’s request, they can earn one day’s salary for up to half of the normal daily working hours. They can earn two days’ salary for more than half of the normal daily working hours, and two days’ salary plus overtime for work that is beyond the normal daily working hours; and

- If the employee works on their rest day, but it’s at the employee’s request, they can earn half a day’s salary for up to half of the normal daily working hours. They can earn one day’s salary for more than half of the normal daily working hours, and one day’s salary plus overtime for work that is beyond the normal daily working hours.

The regulation on working hours only applies to workmen, generally defined as someone who works in manual labor and does not earn more than S$4,500 per month (US$3,347), and non-workmen who is covered under the EA and earns no more than S$2,500 (US$1,859) per month.

Salary computation

Salary is calculated on the basis of a complete calendar month, irrespective of the total number of days in a month. An incomplete month would refer to a month in which an employee:

- Starts employment after the first working day of the month;

- Leaves employment before the end of the month;

- Takes any unpaid leave during the month; or

- Is on national service reservist training during the month.

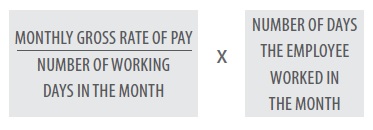

The formula for calculating salary for an incomplete month is as below:

Under the Employment Act, an employer must pay salary to his/her employees at least once a month. The employer may also pay the salary at shorter interval if they choose. Salary must be paid:

- Within seven days after the end of the salary period; or

- In case of overtime work, within 14 days after the end of the salary period.

Under other circumstance, salary payable is given in the table below:

| Final Salary Payable to Employees under Different Situations | |

| Employee resigns and serves the required notice period | On the last day of employment |

| Employee resigns without notice and does not serve the required notice period | Within seven days of the last day of employment |

| Dismissal on grounds of misconduct | On the last day of employment. If this is not possible, then within three working days from the date of dismissal. |

| Employer terminates the contract | On the last day of employment. If this is not possible, then within three working days from the date of termination. |

Variable wage components

The variable portion of your wages can include the 13th month bonus or Annual Wage Supplement (AWS), bonus and variable payments. These payments are not compulsory unless they are in the employment key terms.

Annual Wage Supplement (AWS)

The AWS, also called the “13th month payment,” is a single annual payment on top of an employee’s total annual wage.

AWS is not compulsory. Payment is subject to the terms of employment contract or collective agreement. Employers are encouraged to give their employees AWS to reward them for contributing to the company’s performance.

Bonus

A bonus is a one-time payment to reward employees for their contributions to the company. It is usually offered at the end of the year.

Bonus payments are not compulsory, unless specified in the employment contract or collective agreement.

Variable payment

A variable payment is an incentive payment to increase productivity or reward employees for their contributions.

Variable payments are not compulsory, unless specified in the employment contract or collective agreement.

The Progressive Wage Model

Singapore recently established the Progressive Wage Model in certain job roles, including:

- Cleaning;

- Security;

- Landscape;

- Lift and escalator;

- Retail;

- Food services; and,

- Waste management

The Singapore government also encourages employers to use the PWM for foreign workers in these sectors.

Under this model, the respective lead sector agencies are responsible for regulating the Progressive Wage Model (PWM) in different sectors with implementation mechanisms of PWM varying across sectors. Businesses engaging in the above listed sectors can find more information about the PWM here.